Marvell Technology, Inc., a leading entity in the semiconductor design sector, recently disclosed its quarterly financial results on February 18, 2026. The company, headquartered in the United States, is renowned for its specialization in the development and production of semiconductors and related technologies. Marvell’s product offerings encompass security and networking platforms, secure data processing, and solutions for networking and storage, catering to a global customer base.

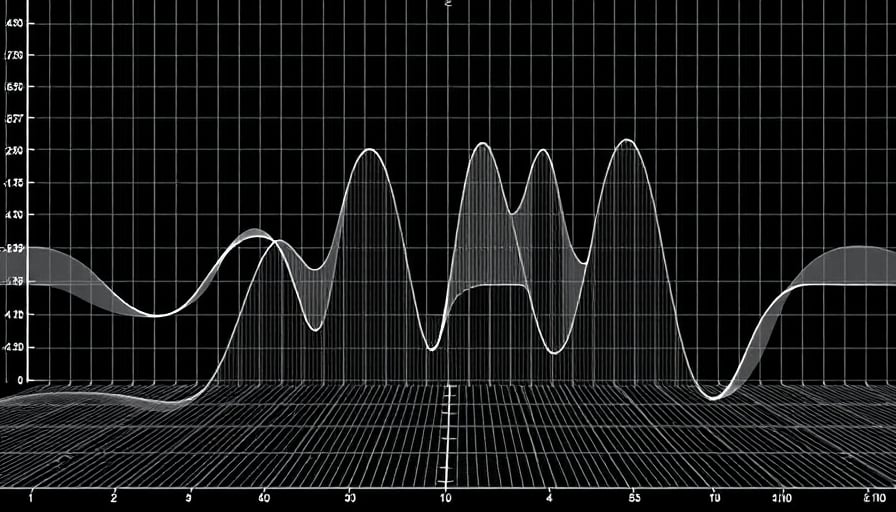

As of the close of trading on February 18, 2026, Marvell’s stock was valued at $79.01. This figure situates the stock within a 52-week trading range, with a low of $47.09 recorded on April 6, 2025, and a high of $111.00 reached in February 2025. The stock’s performance reflects a moderate level of volatility over the past year, indicative of the dynamic nature of the semiconductor industry.

Marvell Technology is listed on the Nasdaq stock exchange, with a market capitalization of $68.96 billion as of the latest data. The company’s valuation metrics, including a price-to-earnings (P/E) ratio of 27.66 and a price-to-book (P/B) ratio of 4.88, suggest that its shares are trading at a premium relative to both its earnings and book value. These ratios highlight investor confidence in Marvell’s growth prospects and its strategic positioning within the technology sector.

Despite the absence of recent earnings updates or significant market catalysts, Marvell’s stock has maintained a period of relative stability. This stability may be attributed to the company’s robust product portfolio and its ability to adapt to the evolving demands of the semiconductor market. Marvell’s focus on security and networking solutions, in particular, aligns with the increasing emphasis on cybersecurity and data protection in the digital age.

For further information about Marvell Technology, Inc., stakeholders and interested parties are encouraged to visit the company’s official website at www.marvell.com . The website provides comprehensive insights into Marvell’s operations, strategic initiatives, and future outlook, offering a valuable resource for investors and industry analysts alike.