Microvast Holdings Inc. Sees Significant Market Activity and Positive Earnings

Microvast Holdings Inc. (NASDAQ: MVST) recorded a sharp increase in share price and trading volume amid a series of events that have drawn attention from both retail and institutional investors. The stock, which closed at $6.40 on October 15, 2025, surged 19 % on Wednesday, October 17, reaching a new intraday high that surpassed its 52‑week high of $7.12.

Drivers of the Recent Rally

Regulatory Developments in China

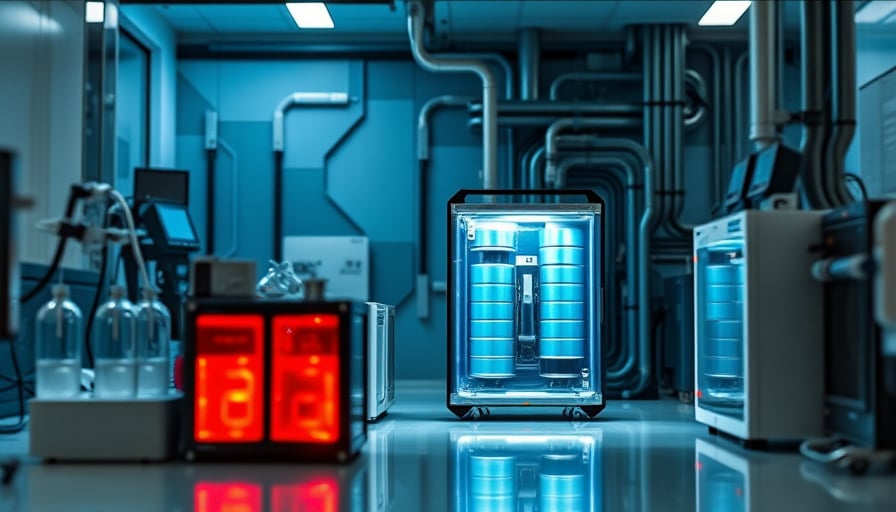

- InsiderMonkey reported that a recent tightening of lithium‑battery regulations in China has bolstered demand for advanced battery technology, positioning Microvast favorably. The company’s all‑solid‑state battery (ASSB) platform, which eliminates liquid electrolytes, is cited as a key differentiator for safety‑sensitive electric vehicle (EV) and grid‑storage markets.

- The regulatory shift is expected to increase the market share of companies that can provide safer, more efficient battery solutions, directly benefiting Microvast’s product portfolio.

Strong Quarterly Results

- Microvast released its second‑quarter earnings on October 16. Revenue climbed to $91.3 million, a 9.2 % year‑over‑year increase from $83.7 million reported in the same quarter last year.

- Adjusted EBITDA improved markedly, rising from a negative $78.4 million in Q2 2024 to a positive $25.9 million in Q2 2025.

- The company maintained its revenue guidance of $450 million for the year, suggesting sustained growth momentum.

Institutional Interest and Options Activity

- American Banking News highlighted an unusually high volume of options trading on Monday, with 12,681 call options executed—an increase of approximately 113 % over the typical volume of 5,956.

- Institutional investors such as Bank of America Corp and SBI Securities Co. Ltd. have increased their holdings significantly in the last quarter, adding 74,393 shares and 69,989 shares, respectively.

- Hedge funds and investment advisers have also shown renewed interest, as evidenced by the sizeable purchases reported for FNY Investment Advisers LLC and SBI Securities.

After‑Hours Trading Surge

- Benzinga noted that MVST experienced a notable after‑hours rally. The spike was attributed to the combination of the aforementioned earnings release, regulatory news, and heightened options activity, which together created a favorable risk‑reward profile for traders.

Market Impact

- The share price movement on October 17, where the stock rose by 19 %, was accompanied by a substantial increase in trading volume, reflecting heightened liquidity and investor enthusiasm.

- The jump has also attracted media attention, with IBTimes discussing the company’s 2,806 % year‑over‑year gain and positioning it as a potential “must‑buy” for investors focused on battery technology.

Outlook

Microvast’s all‑solid‑state technology remains central to its strategy, aiming to capture growing demand across electric vehicles, grid storage, and robotics. The company’s ability to improve profitability while scaling production could sustain its upward trajectory. Investors are watching the company’s continued execution against its revenue guidance and the broader regulatory environment in key markets such as China.