Minbos Resources Ltd, an Australian company operating within the Materials sector, specifically in the Metals & Mining industry, has recently come under scrutiny due to its volatile performance on the ASX All Markets stock exchange. As of September 16, 2025, the company’s close price stood at a modest 0.057 AUD, a stark contrast to its 52-week high of 0.094 AUD recorded on December 5, 2024. This decline is indicative of the challenges faced by the company in maintaining investor confidence amidst fluctuating market conditions.

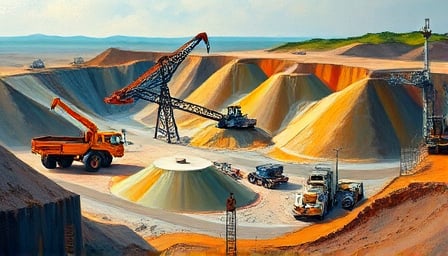

Operating primarily in Angola, Minbos Resources Ltd focuses on the exploration and production of phosphate, a critical component in agricultural fertilizers. Despite the essential nature of its product, the company’s market capitalization of 55,577,827 AUD reflects a significant undervaluation, raising questions about its strategic direction and operational efficiency.

The company’s recent performance highlights a concerning trend of instability. The 52-week low of 0.036 AUD, observed on May 21, 2025, underscores the precarious position Minbos Resources finds itself in. This volatility not only affects shareholder value but also raises red flags about the company’s ability to sustain its operations in a competitive and resource-intensive industry.

Investors and stakeholders are increasingly questioning the company’s management strategies and their ability to navigate the complex geopolitical and economic landscape of Angola. The fluctuating close prices suggest a lack of coherent strategy or perhaps an overestimation of the company’s potential in the region. This inconsistency is alarming, given the critical role of phosphate in global agriculture and the potential for growth in emerging markets.

Moreover, the company’s listing on the ASX All Markets stock exchange, while providing a platform for raising capital, also subjects it to rigorous scrutiny by investors and analysts. The recent performance metrics indicate that Minbos Resources Ltd may be struggling to meet these expectations, further exacerbating investor concerns.

In conclusion, Minbos Resources Ltd faces a pivotal moment in its corporate journey. The company must address its operational challenges and strategic missteps to regain investor confidence and stabilize its market position. Failure to do so could result in further erosion of its market capitalization and potentially jeopardize its long-term viability in the phosphate industry. The coming months will be critical for Minbos Resources Ltd as it seeks to navigate these turbulent waters and chart a course towards sustainable growth and profitability.