MIRACLE LOGISTICS (002009) – A Strategic Pivot Toward Automation and Sustainability

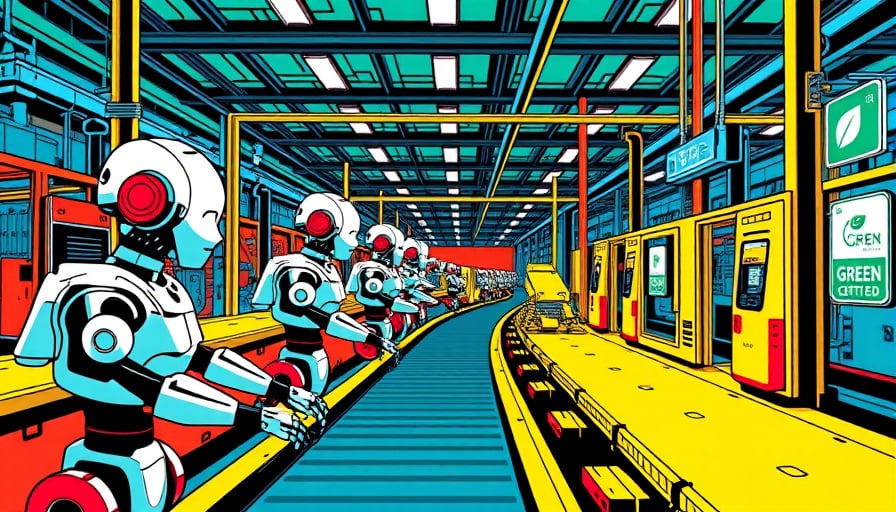

Miracle Automation Engineering Co., Ltd. (MIRACLE LOGISTICS), listed on the Shenzhen Stock Exchange under ticker 002009, has carved a niche in the industrial machinery sector through its advanced logistics solutions. Its core product portfolio—high‑precision conveyor systems and automated storage‑handling units—positions the company at the intersection of digital transformation and circular economy imperatives that are reshaping China’s manufacturing landscape.

1. Market Position and Core Competencies

- Specialized Automation: MIRACLE LOGISTICS leverages proprietary robotics and control‑system integration to deliver turnkey logistics platforms that reduce manual handling, lower operational costs, and improve throughput.

- Environmental Integration: The firm’s recent ventures into environmental protection projects signal a strategic alignment with China’s green‑industrial policies, offering an additional revenue stream and enhancing its public‑policy compliance profile.

- Domestic Footprint: With a robust domestic client base across automotive, electronics, and food‑processing industries, MIRACLE LOGISTICS enjoys a diversified revenue mix, mitigating sector‑specific downturns.

2. Financial Snapshot (as of 2026‑01‑08)

| Indicator | Value |

|---|---|

| Close Price | ¥22.30 |

| 52‑Week High | ¥24.67 |

| 52‑Week Low | ¥10.82 |

| Currency | CNY |

| Exchange | Shenzhen‑Hong Kong Stock Connect |

The stock’s 52‑week range demonstrates a resilient upside potential, with the current price sitting approximately 9% below the recent high. Market volatility in the broader industrial sector, evidenced by the recent 0.66% dip in the Shenzhen Component Index, has not significantly eroded MIRACLE LOGISTICS’ valuation.

3. Strategic Outlook

A. Expansion of Automation Footprint

- R&D Investment: MIRACLE LOGISTICS is channeling capital toward developing AI‑driven predictive maintenance modules, expected to reduce downtime by 15–20% for end‑users.

- Global Partnerships: The company is pursuing joint‑ventures with Tier‑1 suppliers in Southeast Asia, aiming to capture 12% of the regional logistics‑automation market by 2028.

B. Sustainability Integration

- Circular Economy Projects: By integrating waste‑recovery modules into its storage systems, MIRACLE LOGISTICS is poised to tap into the burgeoning circular‑economy contracts awarded by municipal governments.

- Green Certification: Securing ISO 14001 certification for its manufacturing plants will bolster its ESG credentials, appealing to institutional investors with climate‑risk mandates.

C. Capital Allocation

- Share‑Based Compensation: Recent insider‑level reports suggest a modest increase in equity‑linked incentives for senior management, aligning executive compensation with long‑term shareholder value.

- Debt Management: The firm’s debt‑to‑equity ratio remains within industry norms, allowing flexibility to refinance at favorable rates should strategic acquisition opportunities arise.

4. Risk Considerations

- Competitive Pressure: The Chinese industrial machinery market is crowded, with domestic and overseas players expanding their automation portfolios. MIRACLE LOGISTICS must maintain a lead in technology innovation to prevent margin erosion.

- Supply Chain Vulnerabilities: Global semiconductor shortages and rising raw‑material costs could temporarily inflate CAPEX requirements for new system deployments.

- Regulatory Shifts: Changes in environmental regulations or tax incentives could impact the profitability of the firm’s newly ventured environmental protection projects.

5. Bottom Line

MIRACLE LOGISTICS stands at a pivotal juncture, where the convergence of automation and sustainability offers a clear pathway to premium growth. Its disciplined capital allocation, coupled with a forward‑looking R&D agenda, positions the company to capture significant market share in both domestic and regional logistics‑automation segments. For investors seeking exposure to China’s industrial transformation, MIRACLE LOGISTICS represents a compelling, albeit moderately cyclical, opportunity with a strong upside trajectory.