Moody’s Corp: A Week of Significant Financial Movements

In a week marked by pivotal financial developments, Moody’s Corporation, a leading credit rating, research, and risk analysis firm, found itself at the center of significant market activity. Based in New York and listed on the New York Stock Exchange, Moody’s plays a crucial role in the capital markets industry, offering a range of services from credit ratings to risk scoring software. As of May 15, 2025, Moody’s shares were trading at $488.9, with a market capitalization of approximately $87.67 billion.

Downgrade of U.S. Government Credit Rating

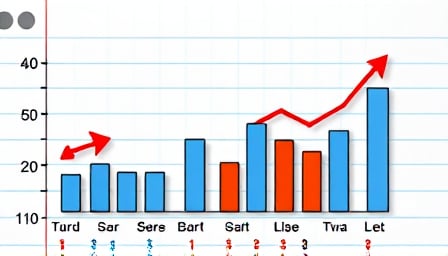

The most notable event of the week was Moody’s decision to downgrade the U.S. government’s credit rating from Aaa to Aa1. This move, announced on May 16, 2025, was driven by concerns over the increasing government debt and the burden of high interest rates on the amount owed. This downgrade marked the first time the U.S. lost its top-tier AAA rating, as both Fitch Ratings and S&P Global Ratings had previously adjusted the U.S. rating below AAA. The market reacted swiftly, with U.S. stock indices showing weakness and Treasury yields climbing, while gold prices saw a narrowing of their decline.

Affirmations in Mexico

In contrast to the U.S. downgrade, Moody’s Local México affirmed several credit ratings in Mexico. On May 16, 2025, Moody’s confirmed the ratings of Construcciones MS, Xignux, and the AAA.mx rating for Banobras’ bond reopening. Additionally, on May 15, Moody’s affirmed CYDSA’s issuer rating and adjusted its outlook to stable. These affirmations underscore Moody’s ongoing commitment to providing reliable credit assessments across different markets.

Market Reactions and Broader Implications

The downgrade of the U.S. credit rating has sparked discussions about its potential impact on asset prices and the broader financial landscape. Analysts are closely monitoring how this change might affect stock, bond, and gold markets. The downgrade could lead to increased borrowing costs for the U.S. government and potentially influence global financial markets.

Investment Insights

Amid these developments, investors are also considering other investment opportunities. A comparison between BBSEY and MCO was highlighted, with investors weighing which stock offers better value in the current market environment. Additionally, Warren Buffett’s Berkshire Hathaway made notable portfolio adjustments in the first quarter of 2025, reflecting strategic shifts in response to market conditions.

Conclusion

Moody’s Corp’s recent activities have underscored its influential role in the financial markets. The downgrade of the U.S. credit rating is a significant development with far-reaching implications, while the affirmations in Mexico highlight Moody’s diverse global operations. As markets continue to react, investors and analysts will be watching closely to understand the full impact of these changes.