Financial Update: Nanjing Sciyon Wisdom Technology Group Co Ltd

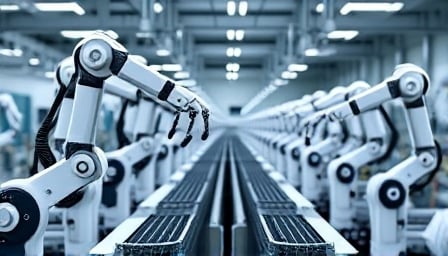

Nanjing Sciyon Wisdom Technology Group Co Ltd, a China-based company listed on the Shenzhen Stock Exchange, has been making significant strides in the Information Technology sector, particularly in industrial automation and digitalization. As of August 25, 2025, the company’s close price stood at 27.2 CNH, with a market capitalization of 6.34 billion CNH. The company’s price-to-earnings ratio is 23.993, reflecting its growth potential in the market.

Recent Market Movements

On August 27, 2025, the A-share market experienced a surge, with the ChiNext Index climbing 2.41% to surpass the 2800-point mark. This rally was fueled by the release of the “Artificial Intelligence + Action” guidelines, which boosted the entire AI industry chain, including sectors like computing power, intelligent robotics, and GPU concepts.

ETF Performance

The Robot ETF (159770) saw a significant increase of over 3%, marking a “V” shape recovery in its performance. This ETF, which tracks the performance of companies in the robotics sector, reached a new high with a scale of 79.32 billion CNH and a share count of 75.23 billion shares as of August 26, 2025. The ETF experienced net inflows of 3.25 billion CNH over four days, indicating strong investor interest.

Key Players in the Market

Among the standout performers in the Robot ETF were companies like Keda Intelligent (300222), Yun Tianfei (688343), and Dongjie Intelligent (300486), with Keda Intelligent experiencing a remarkable 19.98% increase. These companies are part of the broader AI and robotics industry, which has been benefiting from the government’s push towards digitalization and automation.

Sector-Specific Developments

In a related development, Keda Intelligent (002380) reached its price limit, marking its sixth limit-up in the past year. The company reported a 21.78% increase in revenue and a 23.09% increase in net profit for the first half of 2025, continuing its high-growth trajectory. Keda Intelligent has positioned itself as a leading supplier of AI robotics, particularly in the “shovel-type” segment, and has seen its core products like DCS and PLCs gain significant traction in industries such as power generation, steel, and cement due to their autonomous control capabilities.

Conclusion

Nanjing Sciyon Wisdom Technology Group Co Ltd and its peers in the AI and robotics sectors are at the forefront of China’s push towards industrial digitalization. With strong financial performance and strategic positioning in key industries, these companies are well-placed to capitalize on the growing demand for automation and intelligent solutions. Investors and market watchers will continue to monitor these developments closely, as they could have significant implications for the broader technology and industrial sectors.