NetEase Inc. Expands AI‑Driven Innovation Beyond Gaming

NetEase Inc. (HKEX: 9999) has announced a strategic shift that extends its artificial‑intelligence (AI) capabilities from its core gaming division into broader industrial applications. According to a recent feature by k.sina.com.cn published on 31 January 2026, the company is building an integrated innovation chain that links virtual environments to tangible, real‑world assets such as mining equipment.

Key Highlights

| Item | Detail |

|---|---|

| Sector | Communication Services |

| Industry | Entertainment |

| Primary Exchange | Hong Kong Stock Exchange |

| Currency | HKD |

| Market Capitalisation | HKD 603.84 billion |

| Price‑to‑Earnings Ratio | 16.37 |

| Closing Price (29 Jan 2026) | HKD 205 |

| 52‑Week High | HKD 248 (16 Sep 2025) |

| 52‑Week Low | HKD 131.9 (6 Apr 2025) |

Strategic Initiative

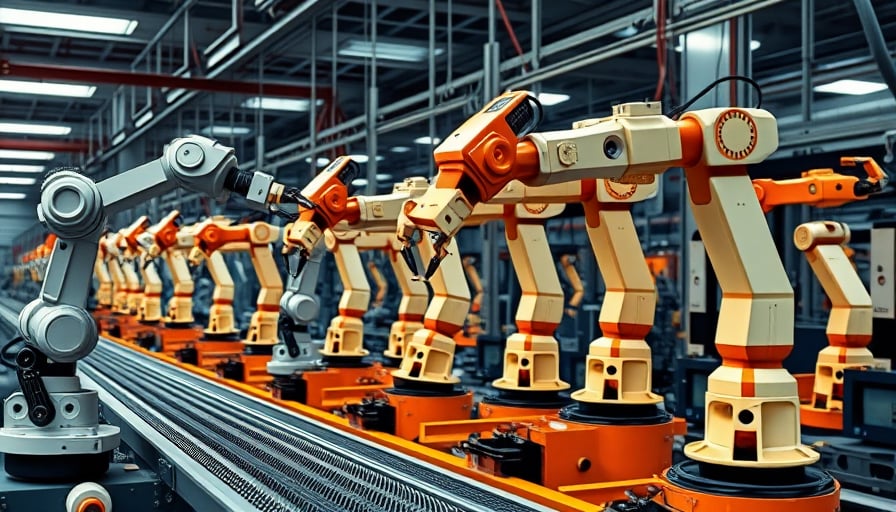

- AI‑Enabled Value Chain: NetEase is deploying AI technologies to bridge the gap between digital entertainment and physical industry sectors. The company’s research indicates that AI can enhance operational efficiency in mining, logistics, and manufacturing, thereby creating new revenue streams outside the gaming market.

- Innovation Ecosystem: By integrating AI across its product portfolio—online games, e‑commerce, internet media, and “innovative businesses”—NetEase aims to strengthen its position as a driver of “new‑quality productivity” in China’s digital economy.

- International Expansion: The company’s existing footprint in Japan and North America provides a platform for scaling AI solutions globally. NetEase intends to leverage its international presence to capture opportunities in markets where AI adoption is accelerating.

Market Context

NetEase’s current share price of HKD 205 sits approximately 18 % below its 52‑week high, reflecting broader market volatility that also affected commodities such as gold and silver in late January 2026. The company’s valuation, at a price‑to‑earnings ratio of 16.37, remains within the typical range for technology and entertainment firms listed in Hong Kong.

Outlook

NetEase’s pivot toward AI‑driven industrial applications signals a diversification strategy aimed at reducing dependence on the highly competitive gaming sector. If successfully executed, the initiative could open new high‑margin business lines and reinforce the company’s status as a leading internet technology provider in Asia and beyond.