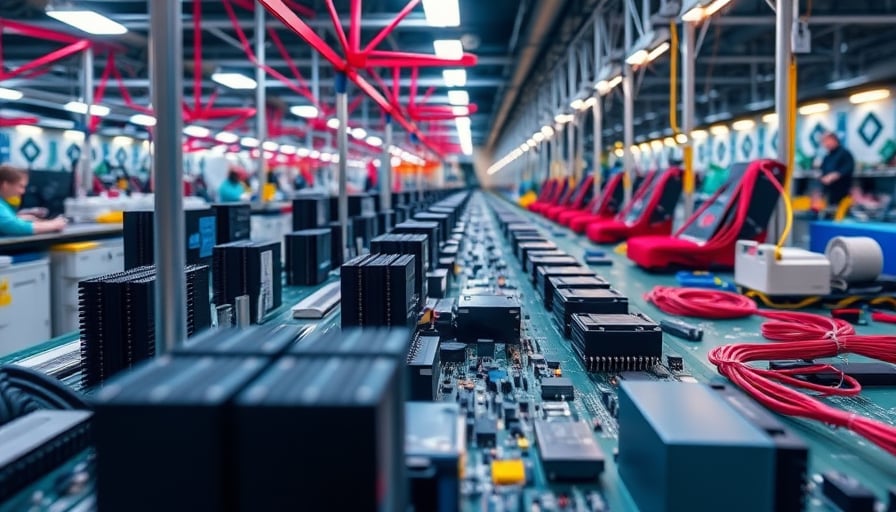

Netlist Inc., a U.S.-based company operating within the Information Technology sector, specializes in the development and manufacturing of computer memory subsystems. These products are primarily targeted at original equipment manufacturers (OEMs) who incorporate them into servers and high-performance computing and communication markets. The company’s offerings can be explored further on their website, www.netlistinc.com .

Traded on the OTC Bulletin Board, Netlist Inc. has experienced significant fluctuations in its stock price over the past year. As of February 19, 2026, the closing price was $1.13. The stock reached its 52-week high of $1.32 on January 25, 2026, and its 52-week low of $0.45 on November 13, 2025. These price movements reflect the volatility and challenges faced by the company in the competitive technology sector.

Financially, Netlist Inc. is currently in a loss-generating position, as indicated by its negative price-to-earnings ratio of -7.46 and a price-to-book ratio of -24.9981. These valuation multiples suggest that the company’s equity base is substantially under-valued relative to its market price, highlighting the financial difficulties it faces.

In recent legal developments, a federal court affirmed Micron Technology’s Patent Trial and Appeal Board (PTAB) loss in a patent dispute with Netlist. This decision, reported on February 20, 2026, by Law360, marks a significant moment in the ongoing legal battles over intellectual property rights within the tech industry.

Netlist Inc. made its initial public offering on November 30, 2006, and has since navigated the complexities of the technology market. Despite the current financial and legal challenges, the company continues to focus on its core business of providing advanced memory subsystems to OEMs, aiming to strengthen its position in the high-performance computing and communication sectors.