Nevada Sunrise Metals Corp: A Rocky Road Ahead?

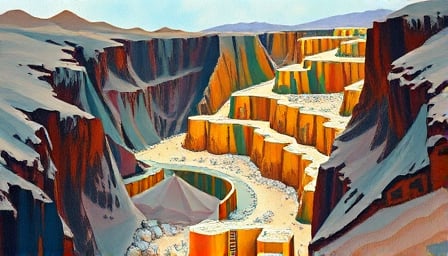

In the volatile world of junior mining companies, Nevada Sunrise Metals Corp stands as a testament to the high-risk, high-reward nature of the sector. Based in Vancouver, Canada, this junior resource exploration company has been navigating the tumultuous waters of the TSX Venture Exchange, focusing on gold, lithium, copper, cobalt, and other base metals. However, recent financial indicators suggest that the company’s journey is far from smooth sailing.

As of April 29, 2025, Nevada Sunrise Metals Corp’s stock closed at a mere 0.02 CAD, a stark reminder of the challenges facing the company. This figure is alarmingly close to the 52-week low of 0.01 CAD, recorded on February 17, 2025. Such volatility is not uncommon in the junior mining sector, but it raises questions about the company’s stability and future prospects.

The company’s market capitalization stands at 2,270,000 CAD, a figure that might seem modest but is significant for a junior explorer. However, the real eye-opener is the Price Earnings (P/E) ratio of -15.87. This negative P/E ratio is a red flag for investors, indicating that the company is not currently profitable. It suggests that Nevada Sunrise Metals Corp is burning through cash without generating earnings, a precarious position for any company, let alone one in the resource exploration sector.

Exploration vs. Earnings: A Delicate Balance

Nevada Sunrise Metals Corp’s focus on exploring and developing properties for gold, lithium, copper, cobalt, and other base metals is ambitious. The demand for these metals, especially lithium and cobalt, is surging, driven by the global shift towards renewable energy and electric vehicles. However, exploration is a long and costly process, with no guaranteed returns. The company’s current financial metrics suggest that it is struggling to balance the costs of exploration with the need to generate earnings.

The 52-week high of 0.05 CAD, achieved on June 4, 2024, reflects a moment of optimism for the company and its investors. Yet, the subsequent decline to its current levels underscores the volatile nature of the mining sector and the challenges of sustaining investor confidence.

Looking Ahead: Challenges and Opportunities

For Nevada Sunrise Metals Corp, the path forward is fraught with challenges. The company must navigate the complexities of exploration, regulatory hurdles, and the ever-present need to secure financing. However, the potential rewards are significant. The global demand for the metals that Nevada Sunrise Metals Corp is exploring is only set to increase, offering the company a chance to capitalize on these trends.

To turn its fortunes around, Nevada Sunrise Metals Corp will need to demonstrate progress in its exploration efforts, secure additional financing, and, crucially, begin to generate earnings. The company’s ability to do so will be closely watched by investors and industry analysts alike.

In conclusion, Nevada Sunrise Metals Corp stands at a crossroads. The company’s future will depend on its ability to manage the inherent risks of the mining sector while capitalizing on the growing demand for its target metals. For investors, the company represents a high-risk, high-reward opportunity, emblematic of the broader challenges and opportunities facing the junior mining sector.