Nexchip Semiconductor Corp: A Strategic Overview

In the dynamic landscape of the semiconductor industry, Nexchip Semiconductor Corporation has emerged as a pivotal player, particularly within the Chinese market. As of July 31, 2025, the company’s shares closed at 21.95 CNY on the Shanghai Stock Exchange, reflecting a nuanced trajectory in its financial performance. This article delves into the recent developments and strategic positioning of Nexchip Semiconductor, offering insights into its market influence and future prospects.

Financial Performance and Market Position

Nexchip Semiconductor’s financial metrics reveal a company navigating the complexities of the semiconductor sector with resilience. The company’s market capitalization stands at a robust 40.72 billion CNY, underscoring its significant presence in the industry. Despite a challenging year, with the stock reaching a 52-week low of 13.42 CNY on September 17, 2024, it has shown a commendable recovery, peaking at 28.94 CNY on December 4, 2024. This volatility highlights the broader market dynamics and the company’s strategic responses to external pressures.

The price-to-earnings ratio of 69.58823 indicates investor confidence in Nexchip’s growth potential, despite the high valuation. This ratio reflects the market’s anticipation of future earnings growth, driven by Nexchip’s innovative product offerings and strategic market expansions.

Core Business and Product Offerings

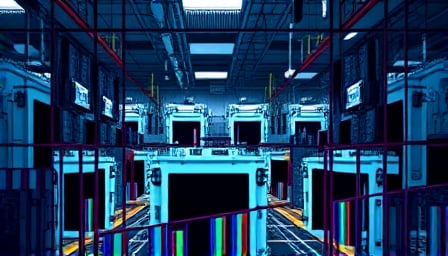

At its core, Nexchip Semiconductor operates an integrated circuit production business, specializing in the manufacturing of 12-inch wafers. This specialization positions the company as a key supplier in the semiconductor supply chain, catering to a diverse range of industries across China. The company’s ability to produce high-quality wafers is a testament to its technological prowess and operational efficiency.

Nexchip’s product portfolio extends beyond wafers, encompassing a variety of semiconductor products that cater to the evolving demands of the tech industry. This diversification strategy not only mitigates risks but also capitalizes on emerging opportunities within the semiconductor sector.

Market Strategy and Expansion

Nexchip Semiconductor’s market strategy is deeply rooted in its commitment to serving the Chinese market. By focusing on domestic demand, the company leverages its understanding of local market dynamics and consumer preferences. This strategic focus is complemented by efforts to expand its product offerings and enhance its technological capabilities.

The company’s marketing efforts are geared towards establishing strong relationships with key industry players, ensuring a steady demand for its products. Nexchip’s strategic partnerships and collaborations further bolster its market position, enabling it to navigate the competitive landscape effectively.

Looking Ahead: Future Prospects

As Nexchip Semiconductor looks to the future, its strategic initiatives are poised to drive growth and innovation. The company’s investment in research and development is crucial for maintaining its competitive edge, particularly in the fast-evolving semiconductor industry. By continuing to innovate and expand its product offerings, Nexchip is well-positioned to capitalize on emerging trends and technologies.

Moreover, the company’s focus on sustainability and operational efficiency will play a critical role in its long-term success. As the global demand for semiconductors continues to rise, Nexchip’s strategic positioning and robust market presence will be instrumental in shaping its future trajectory.

In conclusion, Nexchip Semiconductor Corporation stands at a pivotal juncture, with its strategic initiatives and market positioning setting the stage for sustained growth. As the company navigates the complexities of the semiconductor industry, its commitment to innovation and market expansion will be key drivers of its success in the years to come.