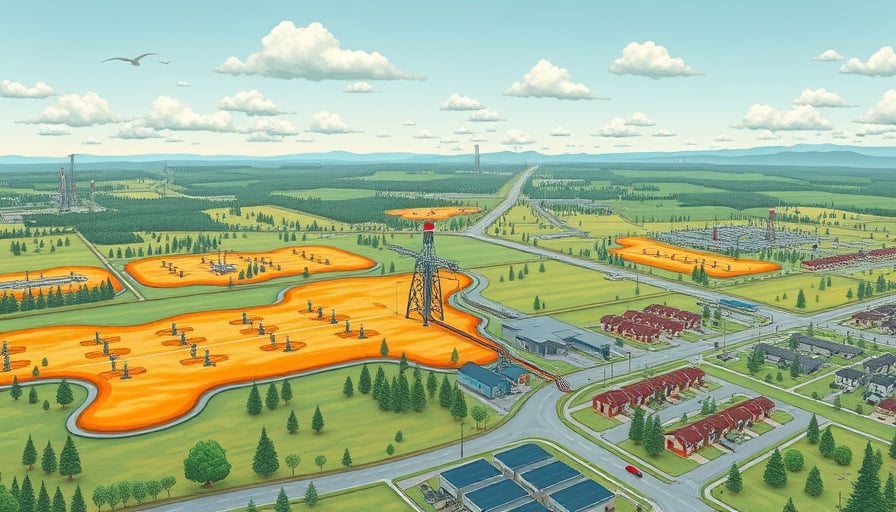

NuEnergy Gas Ltd, an energy company listed on the ASX All Markets, has been making significant strides in its quest to establish itself as a Coal Bed Methane (“CBM”) producer in Indonesia. The company’s strategic focus on building a portfolio of targeted acreage in Indonesia underscores its commitment to tapping into the potential for CBM production in the region. This initiative has placed NuEnergy Gas Ltd in the spotlight, particularly following its recent announcement on 8 January 2026, which highlighted substantial backing to expedite a crucial coalbed methane project.

As of 22 January 2026, NuEnergy Gas Ltd’s share price closed at 0.039 AUD, reflecting a trading range between a 52-week low of 0.017 AUD on 3 April 2025 and a 52-week high of 0.040 AUD on 22 January 2026. This trading activity indicates a volatile yet optimistic market sentiment towards the company’s future prospects. The market capitalization of NuEnergy Gas Ltd stands at 74,840,000 AUD, suggesting a moderate valuation in the context of its industry peers.

Financially, the company presents a challenging picture with a negative price-to-earnings ratio of –78. This metric reflects the company’s current state of losses or negligible earnings relative to its market value. Despite this, the price-to-book ratio of 2.19 indicates that the market values the company at a premium to its book equity. This discrepancy between the negative earnings multiples and the relatively high book valuation suggests that investors are pricing in expectations of future profitability, likely linked to the anticipated success of the Indonesian CBM project.

The strategic backing received for the coalbed methane project is a pivotal development for NuEnergy Gas Ltd. It not only underscores the confidence of investors and stakeholders in the company’s vision but also highlights the potential for significant returns on investment as the project progresses. The focus on Indonesia, a region with substantial untapped CBM resources, positions NuEnergy Gas Ltd at the forefront of the energy sector’s shift towards more sustainable and environmentally friendly fuel sources.

In conclusion, while NuEnergy Gas Ltd currently faces financial challenges, as evidenced by its negative price-to-earnings ratio, the company’s strategic initiatives in Indonesia and the substantial backing for its coalbed methane project paint a promising picture for its future. Investors and industry observers will be keenly watching the company’s progress in realizing its CBM production goals, which could potentially transform its financial landscape and solidify its position in the energy sector.