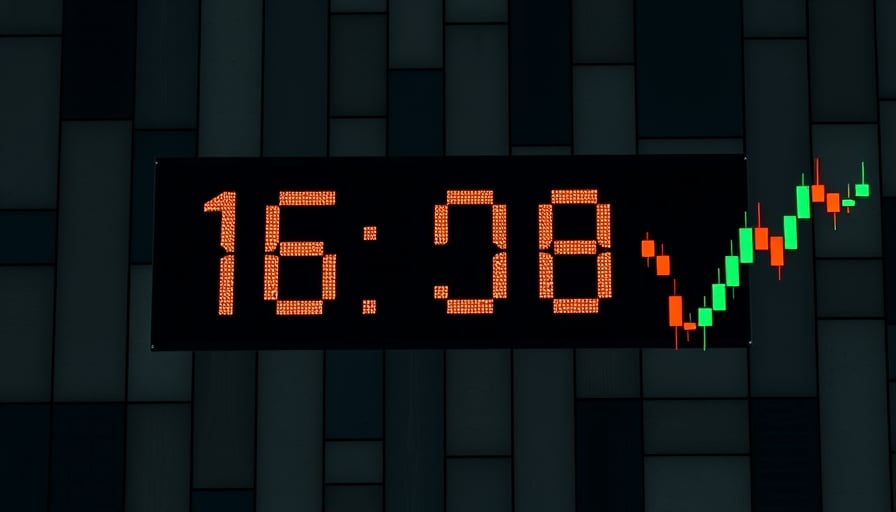

In the ever-evolving landscape of cryptocurrency, Oasis has emerged as a focal point of discussion, particularly in light of its recent performance metrics. As of November 27, 2025, Oasis’s close price stood at $0.0147199, a figure that starkly contrasts with its 52-week high of $0.142684 recorded on December 6, 2024. This dramatic fluctuation underscores the volatile nature of the cryptocurrency market, where fortunes can pivot on the axis of investor sentiment and market dynamics.

The 52-week low of $0.0118568, observed on October 9, 2025, further illustrates the precarious position Oasis finds itself in. Such volatility is not uncommon in the crypto space, yet it raises critical questions about the stability and long-term viability of Oasis as a digital asset. With a market capitalization of approximately $110.8 million, Oasis occupies a modest position within the broader cryptocurrency ecosystem. This valuation, while significant, pales in comparison to the behemoths of the crypto world, suggesting that Oasis may be grappling with challenges in gaining substantial traction or demonstrating compelling value propositions to a wider audience.

The stark disparity between Oasis’s current valuation and its 52-week high is a testament to the speculative nature of cryptocurrency investments. Investors are often lured by the promise of exponential returns, yet the reality is that such gains are accompanied by equally significant risks. The case of Oasis serves as a cautionary tale, highlighting the importance of due diligence and the need for a measured approach to investment in digital currencies.

Moreover, the fluctuations in Oasis’s price point to broader market trends and investor behaviors that are shaping the cryptocurrency landscape. The decline from its 52-week high to its current valuation may reflect a range of factors, including shifts in investor confidence, regulatory developments, or technological advancements within the crypto space. Each of these elements plays a crucial role in determining the trajectory of a cryptocurrency, underscoring the complex interplay of factors that investors must navigate.

In conclusion, the journey of Oasis through the tumultuous waters of the cryptocurrency market serves as a microcosm of the broader challenges and opportunities that define this digital frontier. As investors and enthusiasts continue to monitor Oasis’s performance, it becomes increasingly clear that the path to success in the crypto world is fraught with volatility and uncertainty. The case of Oasis underscores the need for a strategic, informed approach to cryptocurrency investment, one that balances the allure of potential gains with the realities of risk and market dynamics.