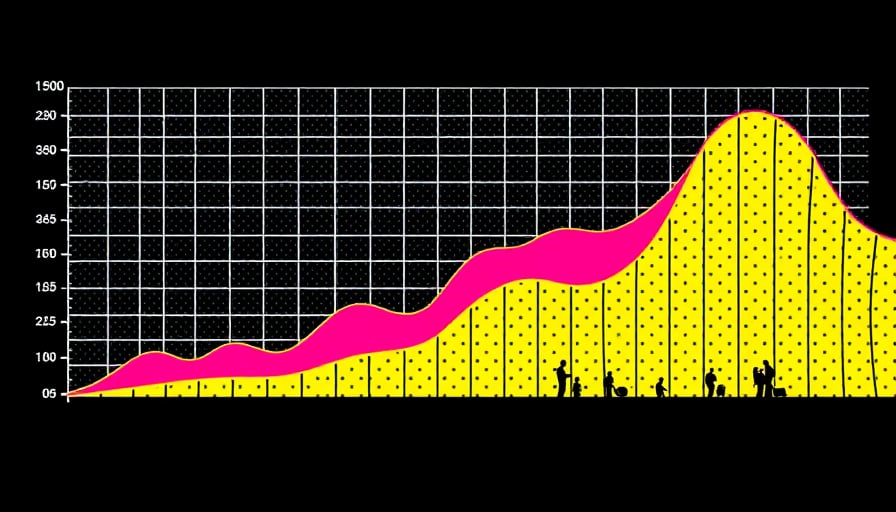

In the ever-evolving landscape of cryptocurrency, Oasis has emerged as a focal point of discussion, particularly in light of its recent performance metrics. As of October 14, 2025, Oasis’s close price stood at $0.0189891, a figure that starkly contrasts with its 52-week high of $0.142684 recorded on December 6, 2024. This dramatic fluctuation underscores the volatile nature of the cryptocurrency market, where fortunes can pivot on the axis of investor sentiment and market dynamics.

The 52-week low, observed on October 9, 2025, at $0.0118568, further accentuates the precarious position Oasis finds itself in. This nadir not only highlights the asset’s susceptibility to market whims but also raises questions about its long-term viability and stability. With a market capitalization of $142,487,369.57, Oasis occupies a modest niche within the broader cryptocurrency ecosystem. This valuation, while not insignificant, prompts a critical examination of its underlying fundamentals and the factors contributing to its current market standing.

The oscillation between its 52-week high and low points to a broader narrative of uncertainty and speculation that often characterizes the crypto space. Investors and market analysts alike are left to ponder the catalysts behind such volatility. Is it a reflection of broader market trends, or does it speak to intrinsic issues within Oasis itself? The answers to these questions are pivotal, not only for potential investors but also for the future trajectory of Oasis as a digital asset.

Moreover, the recent performance of Oasis invites a critical discourse on the sustainability of cryptocurrencies as a whole. With regulatory landscapes evolving and the specter of market saturation looming, the resilience of assets like Oasis is put to the test. The ability of such currencies to adapt and thrive in an increasingly complex and competitive environment is paramount.

In conclusion, the journey of Oasis through the tumultuous waters of the cryptocurrency market serves as a microcosm of the challenges and opportunities that lie ahead for digital currencies. As stakeholders navigate these uncertain waters, the lessons gleaned from Oasis’s recent performance will undoubtedly inform future strategies and decisions. The path forward for Oasis, and indeed for the cryptocurrency sector at large, remains fraught with both peril and promise.