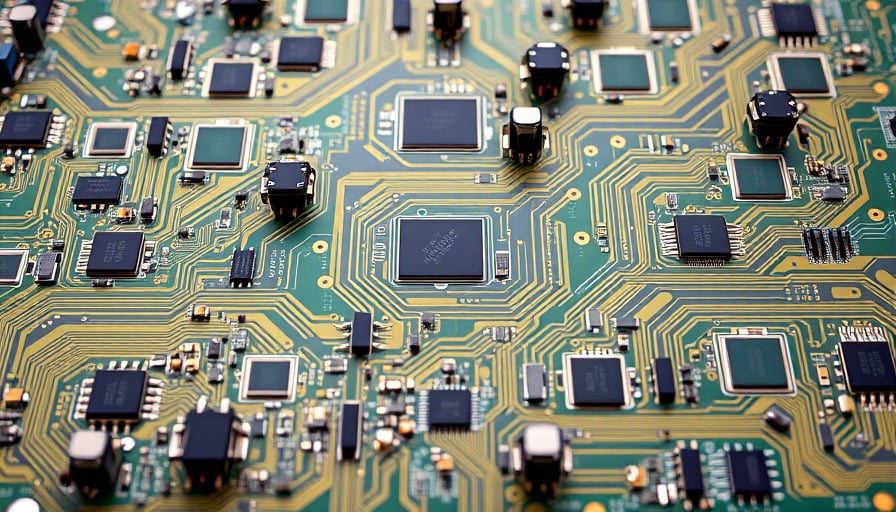

Olympic Circuit Technology Co., Ltd., a prominent player in the Information Technology sector, has recently maintained a steady course amidst a dynamic market environment. As a Chinese company specializing in the manufacturing of electronic components, Olympic Circuit Technology Co., Ltd. continues to focus on producing and distributing printed circuit boards, catering primarily to the automobile, computer, and consumer product industries. The company’s strategic positioning within the Electronic Equipment, Instruments & Components industry underscores its pivotal role in supporting key technological advancements.

The company, listed on the Shanghai Stock Exchange under the ticker 603920, has demonstrated resilience in its financial performance. As of December 9, 2025, the company’s shares closed at 40.99 CNY, reflecting a slight increase from the previous day’s closing price of 40.95 CNY. This trading level situates the stock comfortably above its 52-week low of 20.92 CNY, recorded on April 8, 2025, yet below the 52-week high of 51.35 CNY, achieved on September 17, 2025. This range indicates a moderate level of volatility, with the current price approximately 20% below its all-time high, positioning the stock within a mid-range of its historical performance.

Olympic Circuit Technology Co., Ltd.’s market capitalization stands at 29.52 billion CNY, reflecting its substantial presence in the industry. The company’s valuation metrics, including a price-to-earnings ratio of 35.74 and a price-to-book ratio of 4.43, suggest a premium valuation relative to its book value. These figures indicate investor confidence in the company’s growth prospects and its ability to generate earnings, despite the moderate earnings yield.

In terms of recent developments, the company announced on December 4, 2025, that it had raised partial idle funds for cash management purposes. This strategic move underscores the company’s proactive approach to maintaining liquidity and ensuring financial stability. The absence of further announcements beyond this point suggests a period of consolidation, allowing the company to focus on operational efficiency and strategic initiatives.

Looking ahead, Olympic Circuit Technology Co., Ltd. is well-positioned to capitalize on the growing demand for electronic components across various sectors. The company’s commitment to innovation and quality, coupled with its strategic market positioning, bodes well for its future prospects. Investors and stakeholders can anticipate continued growth and stability as the company navigates the evolving technological landscape.

In conclusion, Olympic Circuit Technology Co., Ltd. remains a key player in the electronic components industry, with a robust financial foundation and strategic initiatives aimed at sustaining growth. As the company continues to adapt to market dynamics, its focus on innovation and operational excellence will likely drive future success.