In a remarkable display of market dynamics, OmniVision Integrated Circuits Group Inc., a key player in the semiconductor industry, has been at the forefront of a significant rally in the A-share market. As of August 28, 2025, the company, along with other tech giants, has been instrumental in leading a V-shaped recovery, with the ChiNext Index and the CSI 300 Technology Index surging over 7%. This surge has been particularly notable in the semiconductor sector, with OmniVision and its peers reaching historical highs.

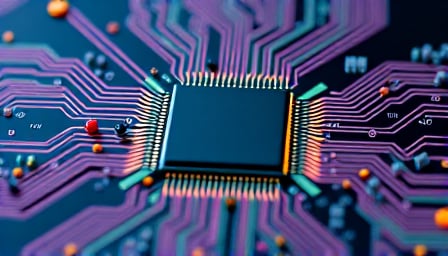

OmniVision, listed on the Shanghai Stock Exchange, specializes in the manufacturing of image sensors and semiconductor products, including complementary metal oxide semiconductors, power devices, and radio frequency devices. The company’s global reach and innovative product line have positioned it as a leader in the semiconductor industry.

The recent market rally has been fueled by several factors. Firstly, the Chinese government’s issuance of the “Implementation Opinions on Deepening the ‘Artificial Intelligence Plus’ Action” has sent a positive signal to the tech sector, particularly benefiting companies like OmniVision that are at the forefront of AI and semiconductor technologies. Additionally, the global demand for AI computing power has surged, further driving the need for advanced semiconductor solutions.

OmniVision’s stock performance has been particularly noteworthy. As of August 27, 2025, the company’s stock closed at 142.89 CNH, with a 52-week high of 161.96 CNH and a low of 81.41 CNH. The company’s market capitalization stands at 156.58 billion CNH, reflecting its significant presence in the semiconductor industry.

The broader market sentiment has been optimistic, with over 2800 stocks across the market experiencing gains. This positive trend is partly attributed to the strategic positioning of companies like OmniVision, which are capitalizing on the growing demand for semiconductor and AI technologies.

Analysts suggest that the rally in tech stocks, including OmniVision, signals a broader consensus towards investing in the technology sector. The company’s recent performance, coupled with favorable government policies and global market trends, positions it well for continued growth. As the demand for AI and semiconductor technologies continues to rise, OmniVision and its peers are expected to play a pivotal role in shaping the future of the tech industry.

In conclusion, OmniVision Integrated Circuits Group Inc. has emerged as a key player in the semiconductor industry’s recent rally. With its strong product portfolio, global market presence, and strategic alignment with industry trends, the company is well-positioned to capitalize on the growing demand for semiconductor and AI technologies. As the market continues to evolve, OmniVision’s role in driving innovation and growth in the tech sector is expected to remain significant.