In the ever-evolving landscape of the biotechnology sector, OSE Immuno, a company listed on the NYSE Euronext Paris, has recently made headlines with its strategic pivot towards addressing chronic pouchitis and hidradenitis suppurativa through its investigational drug, Lusvertikimab. This move, announced on January 29, 2026, underscores the company’s commitment to expanding its therapeutic portfolio amidst a challenging financial backdrop.

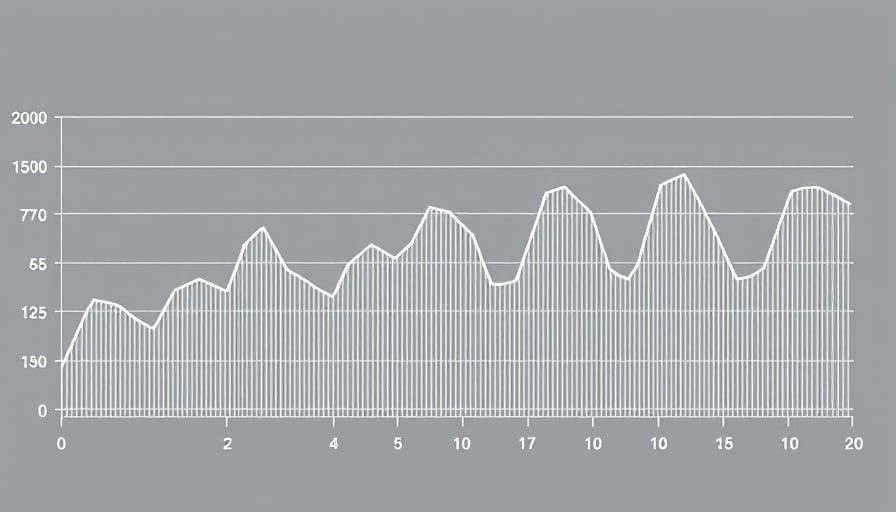

As of February 19, 2026, OSE Immuno’s shares closed at 4.3 EUR, a figure that, while modest, reflects a broader narrative of volatility and resilience. The stock’s journey over the past year has been marked by a significant fluctuation, peaking at 7.7 EUR in October 2025 and dipping to a low of 4.222 EUR just days before the current date. This volatility is emblematic of the inherent risks and uncertainties that characterize the biotechnology industry, particularly for companies like OSE Immuno that are in the throes of drug development and clinical trials.

The financial metrics of OSE Immuno paint a picture of a company navigating through turbulent waters. With a market capitalization of 98,570,000 EUR, the firm’s valuation is underpinned by a price-to-earnings ratio of -2.71, a stark indicator of the negative earnings environment it currently faces. This negative P/E ratio, while not uncommon in the biotech sector, especially for companies heavily invested in research and development, raises questions about the sustainability of its financial model and the potential for future profitability.

Despite these financial challenges, OSE Immuno’s strategic focus on chronic pouchitis and hidradenitis suppurativa as new key therapeutic indications for Lusvertikimab represents a calculated risk. These conditions, both chronic and debilitating, offer a significant unmet medical need, providing OSE Immuno with an opportunity to carve out a niche in the market. The decision to target these indications is not only a testament to the company’s commitment to addressing critical health issues but also a strategic maneuver to differentiate itself in a crowded biotech landscape.

However, the path forward for OSE Immuno is fraught with challenges. The negative earnings environment, coupled with the high-risk nature of drug development, necessitates a careful balancing act between innovation and financial prudence. The company’s ability to navigate these challenges will be critical in determining its long-term viability and success.

In conclusion, OSE Immuno stands at a crossroads, with its recent strategic pivot offering a glimmer of hope amidst a backdrop of financial uncertainty. The company’s focus on chronic pouchitis and hidradenitis suppurativa through Lusvertikimab could potentially redefine its trajectory, offering a beacon of innovation in the quest to address unmet medical needs. However, the road ahead is uncertain, and the company’s ability to surmount the financial and operational hurdles it faces will be pivotal in shaping its future. As stakeholders and observers watch closely, the unfolding story of OSE Immuno serves as a compelling narrative of resilience, innovation, and the relentless pursuit of therapeutic breakthroughs in the face of adversity.