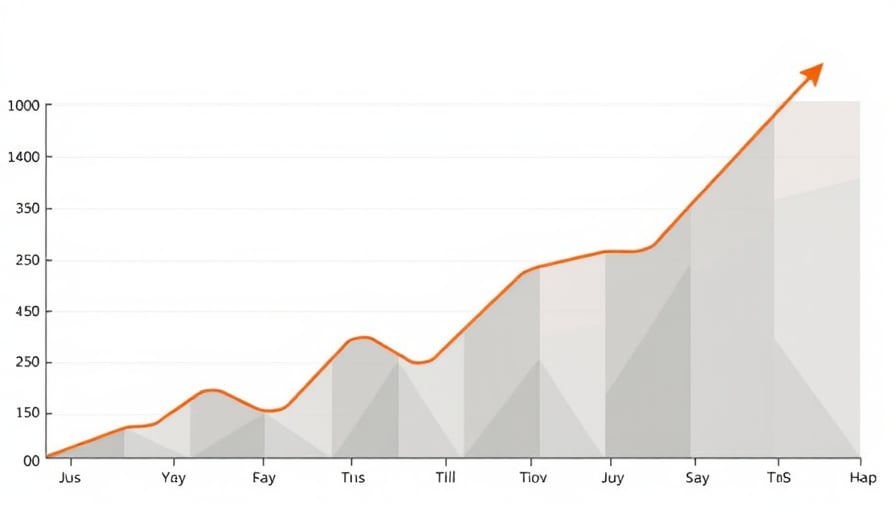

Pattern Group Inc, a company listed on the Nasdaq, has recently been the subject of financial analysis due to its performance metrics and market position. As of October 30, 2025, the company’s close price stood at $17.63, reflecting a notable fluctuation within the year. The stock reached its 52-week high of $18.95 on October 26, 2025, while its lowest point was recorded at $12 on September 24, 2025. This volatility highlights the dynamic nature of the market and the varying investor sentiment towards Pattern Group Inc.

The company’s market capitalization is currently valued at $3.1 billion USD, indicating a substantial presence in the market. This valuation is supported by its financial metrics, including a price-to-earnings (P/E) ratio of 24.58. The P/E ratio suggests that investors are willing to pay $24.58 for every dollar of earnings, which may reflect expectations of future growth or a premium on the company’s perceived value.

Pattern Group Inc’s financial performance and market metrics are critical for investors and analysts who are assessing the company’s potential for growth and stability. The recent close price and historical highs and lows provide insight into the stock’s performance trends and investor confidence. As the company continues to navigate the market, these figures will be essential for making informed investment decisions.

In summary, Pattern Group Inc’s financial indicators, including its market cap and P/E ratio, alongside its stock price movements, paint a picture of a company with significant market influence and investor interest. These metrics will continue to be pivotal in evaluating the company’s future prospects and strategic direction.