Pentair PLC Announces Dividend Enhancement and Share‑Repurchase Initiative

Pentair PLC, the London‑based water technology specialist listed on the Frankfurt Stock Exchange, has announced a decisive move to reward its shareholders and reinforce confidence in its long‑term value creation strategy. On 15 December 2025, the company declared an 8 % increase in its regular quarterly cash dividend, setting the new payment at $0.27 per share effective February 6 2026 for those shareholders of record on January 23 2026. The adjustment translates to an annualized dividend of $1.08 per share, reflecting the firm’s commitment to returning capital in a sustainable manner while maintaining its focus on delivering clean, safe water solutions across residential, commercial, industrial, infrastructure, and agricultural sectors.

In tandem with the dividend hike, Pentair approved a new share‑repurchase programme valued at $1 billion. The buy‑back will be executed over the next 12 months and is intended to align the company’s equity value more closely with its intrinsic worth, thereby enhancing earnings per share and supporting the stock price. The programme underscores Pentair’s confidence in its ongoing operations and the robustness of its cash‑flow generation, which has been supported by a stable portfolio of water treatment and filtration technologies.

Financial Snapshot

- Market Capitalisation: €14.99 billion

- Price‑to‑Earnings Ratio: 26.87

- Close Price (12 Dec 2025): €90.12

- 52‑Week High (16 Dec 2024): €102.15

- 52‑Week Low (8 Apr 2025): €67.00

Pentair’s recent dividend enhancement and share‑repurchase plan come at a time when the company’s share price has remained within a healthy range, reflecting investor confidence in its sustainable water solutions business model. The 8 % increase is the largest single adjustment in 50 years of dividend policy, signaling a renewed emphasis on shareholder returns without compromising investment in research and development.

Strategic Implications

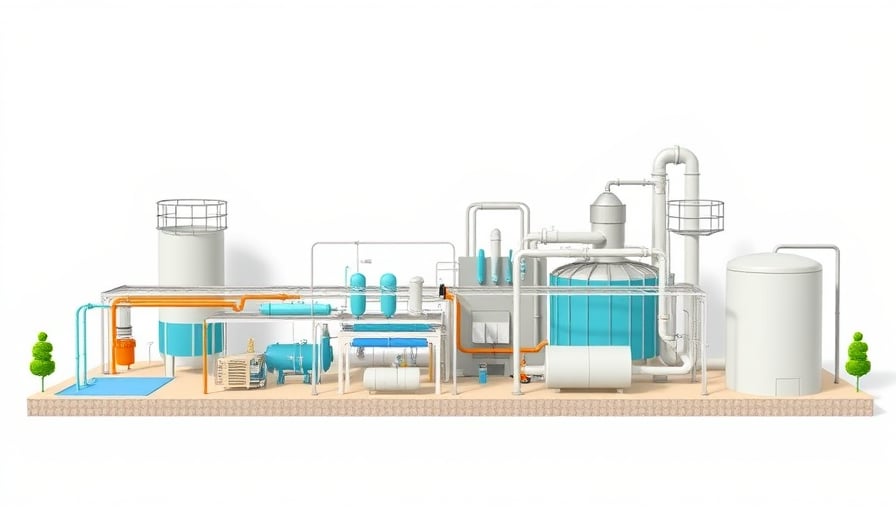

Pentair’s focus on smart, sustainable water technologies positions it favorably amid growing global demand for water efficiency and safety. The company’s portfolio—including advanced filtration systems, water reuse solutions, and smart monitoring platforms—serves a diversified customer base spanning industrial plants, municipal utilities, and agricultural operations. By boosting dividends and executing a substantial share‑repurchase, Pentair sends a clear message that it is well‑capitalised to invest in growth initiatives while simultaneously rewarding shareholders.

The move also aligns with the broader trend of industrial companies strengthening shareholder value in a post‑pandemic recovery environment. Analysts note that the dividend increase, coupled with the share‑buyback, may provide a catalyst for the stock’s price trajectory, potentially improving its standing relative to peers in the machinery and industrial sector.

Outlook

Pentair’s leadership remains steadfast in its commitment to water stewardship and technological innovation. The company is expected to continue expanding its global footprint, particularly in emerging markets where water scarcity is increasingly acute. With a robust capital structure and a clear dividend policy, Pentair is well positioned to navigate the evolving water‑sector landscape while delivering sustained value to its investors.