Plaid Technologies Inc. Announces Corporate Updates and Dividend‑Related Measures

Plaid Technologies Inc., the Canadian company listed on the Canadian National Stock Exchange under the ticker STIF (also traded OTC as STIFF and on the Frankfurt Stock Exchange as 5QX0), released a series of corporate communications on 25 November 2025 that shed light on the status of its expanded‑graphite patent portfolio and a recent shareholder‑friendly action.

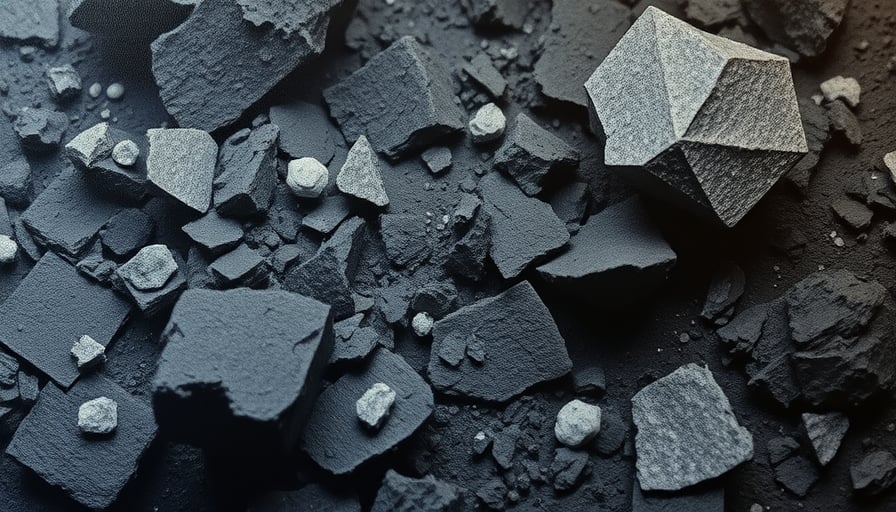

Expanded‑Graphite Patent Progress

The company’s filings, which accompany the September 3, 2025 disclosure, detail the current status of a patent application focused on expanded graphite technology. Plaid has highlighted that the application is progressing through the examination phase and that the associated intellectual‑property rights are being consolidated. The company’s spokesperson emphasized that the technology is central to its product roadmap and could open new markets in energy storage, advanced composites, and thermal management.

Key points from the update include:

| Item | Detail |

|---|---|

| Patent Focus | Expanded graphite |

| Application Status | In examination (Italian jurisdiction) |

| Intellectual‑Property Strategy | Consolidation of related IP and mitigation of transfer risks |

| Consulting Support | Agreement with Petro‑Flow LLC to provide technical and legal counsel |

Plaid’s leadership has reiterated that securing a robust patent position is critical for protecting the company’s competitive advantage as it scales production and explores licensing opportunities.

Share‑Split to Enhance Liquidity

On 24 November 2025, Plaid announced a four‑for‑one share‑split of its common stock. The split will increase the number of shares outstanding by a factor of four, thereby reducing the trading price proportionally. The move is intended to improve liquidity and make the shares more accessible to a broader investor base without altering the company’s overall market capitalization.

According to the company’s statement:

“The four‑for‑one split will be executed in accordance with the applicable securities regulations. Investors who hold shares on the record date will receive four new shares for each existing share. The split will be effective on the trading day following the announcement.”

This step aligns with Plaid’s broader strategy to broaden its shareholder base and enhance market visibility, especially as it prepares for upcoming product launches and potential partnerships.

Trading Resumption and Market Position

On 25 November 2025, the Frankfurt Stock Exchange resumed trading of Plaid’s shares (ISIN CA7261351067) at 08:32 CET after a brief pause. The resumption coincides with the issuance of the corporate updates and the share‑split announcement, signaling renewed investor interest and operational momentum.

At the close of the Canadian National Stock Exchange on 23 November 2025, Plaid’s stock traded at CAD 0.39, reflecting a modest decline from its 52‑week high of CAD 0.66 (achieved on 21 September 2025). Despite the low price, the company’s market capitalization remains stable at approximately CAD 34.8 million.

Outlook

Plaid Technologies Inc. remains focused on advancing its expanded‑graphite technology and securing intellectual‑property rights that will underpin future revenue streams. The recent share‑split and trading resumption are aimed at increasing liquidity and broadening its investor base, positioning the company to capitalize on emerging opportunities in high‑performance materials.

Investors should monitor the company’s progress on patent approvals and the commercialization timeline of its graphite‑based solutions, which will be crucial determinants of long‑term valuation.