PPX Mining Corp. Reports Management Transition and Advances in Plant Construction

PPX Mining Corp. (TSXV:PPX), a Canadian‑based exploration and development company focused on gold and silver assets in northern Peru, announced significant corporate and operational developments on January 13, 2026.

Board and Executive Restructuring

On January 12, 2026, the Company appointed Ernest Mast and Diego Bellido to its Board of Directors. Dr. John Thomas stepped down as Interim Chief Executive Officer, and Mr. Mast assumed the role of President and Chief Executive Officer. Mr. Mast’s background and qualifications were previously disclosed in a press release dated December 22, 2025.

Mr. Bellido brings over 15 years of experience in global commodities trading. A senior executive at Glencore, he serves as Manager for Glencore Peru S.A.C. and Glencore Lima Trading S.A.C. and has held board positions with Perubar S.A. and Transportadora Callao S.A. His academic credentials include a Bachelor’s degree in Business Administration from Universidad del Pacífico (Peru) and an MBA from INSEAD (France). The appointment of Mr. Bellido is expected to strengthen PPX’s strategic relationships in Latin America and enhance its operational oversight.

Progress on the Gold and Silver Processing Plant

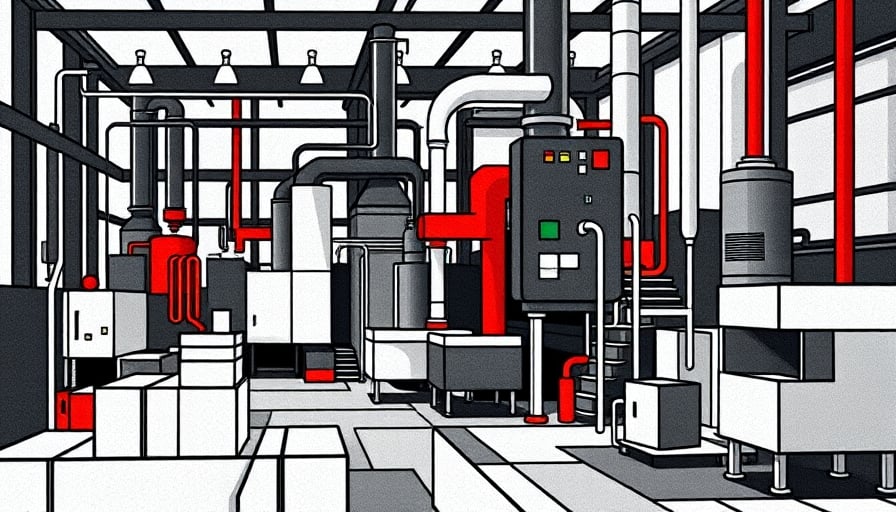

Since the Company’s last update in November 2025, PPX has made substantial strides in the construction of its processing plant. Civil works are now largely complete, allowing the project to shift into the equipment installation and mechanical assembly phase. Key components—such as the crushing and grinding circuits, leach tanks, and flotation facilities—have progressed significantly. The plant’s security perimeter is approximately 80 % complete and is slated to be fully enclosed by the end of the month.

Aerial imagery released by the Company highlights the advancing infrastructure: laboratory facilities, tailings area, water tanks, and a vibrating screen that has already been installed. The expansion of the workforce and the specialized skill set required for the next phases of construction are expected to accelerate site activity in the coming weeks.

Market Context

The stock, listed on the TSX Venture Exchange, traded at CAD 0.31 on January 11, 2026. Over the past 52 weeks the share price has ranged from a low of CAD 0.03 to a high of CAD 0.50. The company’s market capitalization stands at CAD 260 835 648. PPX’s price‑earnings ratio is negative, reflecting its status as an exploration and development enterprise without significant earnings.

Outlook

With new leadership at the helm and a construction project approaching commissioning, PPX Mining Corp. is positioning itself for the next phase of development in Peru. The Company’s updates suggest a deliberate focus on operational readiness and strategic partnerships, both of which are critical to advancing its gold and silver projects. Investors and analysts will likely monitor the transition of the plant to production and the effectiveness of the new executive team in steering the company toward profitability.