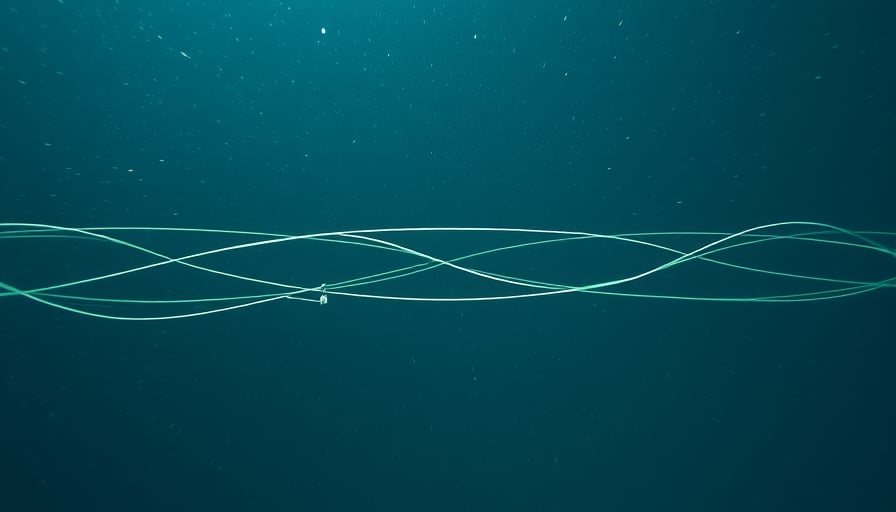

Prysmian SpA Expands Subsea Capabilities with Acquisition of Spanish Submarine Cable Specialist

Prysmian SpA, the Italian leader in electrical equipment and cable solutions, has completed a strategic acquisition that will strengthen its position in the growing subsea market. The company announced on February 10, 2026 that it had closed the purchase of ACSM, a Viguès‑based firm specializing in the design, supply, and installation of submarine cables, for €169 million.

Strategic Rationale

The acquisition aligns with Prysmian’s long‑term vision of becoming the world’s most comprehensive provider of subsea cable solutions. ACSM brings a mature portfolio of submarine cable technologies, a skilled engineering team, and an established customer base across the Mediterranean. By integrating ACSM’s expertise, Prysmian will broaden its product range, enhance its service offerings, and reinforce its footprint in key high‑growth regions such as the Iberian Peninsula and North Africa.

The transaction is expected to generate synergies through cost efficiencies, cross‑selling opportunities, and shared research and development initiatives. Prysmian’s CEO emphasized that the deal would accelerate the company’s ability to deliver end‑to‑end subsea solutions—from cable design to on‑shore installation—thereby improving competitive positioning against global peers.

Financial Impact

The €169 million purchase price represents a moderate premium over ACSM’s recent trading levels, reflecting Prysmian’s confidence in the long‑term value of the acquisition. The deal will be financed through a combination of cash reserves and a modest debt facility, ensuring that the company’s balance sheet remains robust. Given Prysmian’s strong liquidity position—its market capitalization stood at approximately €30.4 billion as of early February—and its healthy cash flow generation from core operations, the acquisition is unlikely to exert undue pressure on its financial metrics.

Market Reaction

European equity markets responded positively to the announcement. On the day following the press release, Prysmian shares traded at €103.80, up from €103.14 at market close on February 9. While the stock’s 52‑week range stretched from a low of €38.57 (April 2025) to a high of €106.55 (February 2026), the recent uptick suggests investor confidence in the company’s strategic direction. Analyst coverage also shifted, with Deutsche Bank downgrading its recommendation from “Buy” to “Hold” on February 9, citing a cautious outlook amid broader market volatility. However, the acquisition has been viewed as a catalyst for future revenue growth, potentially offsetting short‑term valuation concerns.

Broader Industry Context

The subsea cable market is projected to expand significantly through 2036, driven by the rollout of offshore wind farms, submarine telecommunications infrastructure, and energy transmission projects. Recent reports from industry analysts—such as the “Subsea Systems Market Landscape to 2036” and the “EHV Compressor Market Scope & Changing Dynamics 2024‑2033”—highlight rising demand for high‑capacity, low‑loss cables and advanced monitoring solutions. Prysmian’s move to acquire ACSM positions it well to capture a larger share of this lucrative segment and to capitalize on emerging opportunities in renewable energy transmission.

Conclusion

Prysmian’s €169 million purchase of ACSM marks a significant milestone in the company’s growth strategy. By enhancing its subsea capabilities, Prysmian is set to deliver comprehensive cable solutions that meet the evolving demands of the energy and telecommunications sectors. The acquisition not only broadens the company’s product portfolio but also strengthens its competitive stance in an industry poised for sustained expansion.