PVH Corp, a prominent player in the Consumer Discretionary sector, has recently been under the spotlight due to its fluctuating financial performance and strategic positioning within the Textiles, Apparel & Luxury Goods industry. As of September 3, 2025, the company’s stock closed at $89.33 on the New York Stock Exchange, reflecting a significant recovery from its 52-week low of $59.28 on April 7, 2025. However, this recovery still falls short of its 52-week high of $113.47, recorded on December 4, 2024, indicating a volatile market sentiment towards the company.

With a market capitalization of $3.93 billion, PVH Corp’s financial health and strategic maneuvers are under intense scrutiny. The company’s Price Earnings (P/E) ratio stands at 9.704, suggesting a potentially undervalued stock in the eyes of some investors, given the industry’s average P/E ratios. This valuation metric raises critical questions about the company’s growth prospects and its ability to leverage its brand portfolio effectively in a highly competitive market.

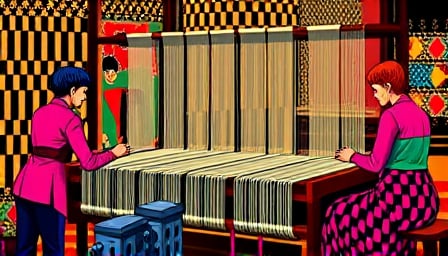

PVH Corp operates as a clothing and apparel accessory business, a sector that demands constant innovation and adaptation to shifting consumer preferences. The company’s ability to navigate these challenges, while maintaining profitability and shareholder value, is paramount. The recent fluctuations in its stock price underscore the precarious balance between operational efficiency and market perception.

The company’s strategic initiatives, aimed at bolstering its position in the luxury goods segment, are particularly noteworthy. In an industry where brand prestige and consumer loyalty are paramount, PVH Corp’s efforts to enhance its brand portfolio and expand its global footprint are critical. However, these endeavors come with inherent risks, including the potential for overextension and the dilution of brand value.

Moreover, the broader economic environment poses additional challenges for PVH Corp. Consumer discretionary spending is highly sensitive to economic cycles, and any downturn could disproportionately affect the company’s revenue streams. The luxury goods segment, while resilient, is not immune to shifts in consumer sentiment and economic uncertainty.

In conclusion, PVH Corp stands at a crossroads, with its future trajectory hinging on its ability to execute strategic initiatives effectively, adapt to market dynamics, and navigate the challenges of the luxury goods industry. The company’s recent stock performance, while indicative of a recovery, also highlights the volatility and uncertainty that lie ahead. As PVH Corp endeavors to solidify its position in the competitive landscape of textiles, apparel, and luxury goods, the stakes could not be higher. The coming months will be critical in determining whether the company can capitalize on its strengths and overcome the challenges that threaten its growth and profitability.