Qorvo Inc: A Week of Financial Highlights and Market Movements

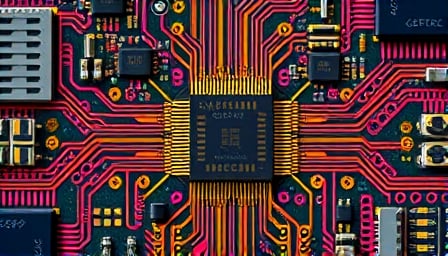

In a week filled with significant financial updates, Qorvo Inc., a leading semiconductor company based in Greensboro, North Carolina, has been at the center of investor attention. Known for its innovative solutions in connectivity and power applications, Qorvo has demonstrated resilience and strategic foresight amidst fluctuating market conditions.

Earnings and Market Performance

The week began with a notable announcement from Qorvo, as the company reported its Q4 2025 earnings, surpassing estimates with an earnings per share (EPS) of $0.33 and revenue reaching $869.5 million. This strong financial performance, highlighted in a series of earnings call transcripts, underscored Qorvo’s robust revenue and earnings, despite navigating market challenges. The company’s strategic positioning for future growth was a focal point, reflecting its commitment to innovation and market leadership.

Analyst Upgrades and Stock Movements

Following the earnings announcement, Qorvo’s stock experienced a surge, buoyed by analyst upgrades and a strong outlook. Benchmark upgraded Qorvo to a “Buy,” citing the company’s solid Q4 performance and promising future prospects. This upgrade, along with a positive earnings call transcript, contributed to a rise in Qorvo’s stock, marking a week of positive momentum for the company.

However, not all news was uniformly positive. Loop Capital adjusted its stock price target for Qorvo to $75 from $90, reflecting a more cautious outlook. Similarly, Needham cut its stock price target to $90, indicating a divergence in analyst perspectives on Qorvo’s future performance.

Strategic Outlook and Growth Prospects

Despite these mixed signals from analysts, Qorvo outlined a 10%+ content growth for its flagship customer in 2025, signaling confidence in its strategic direction and growth prospects. This growth outlook, coupled with the company’s strong financial performance, suggests a resilient path forward.

Market Position and Future Directions

As of April 30, 2025, Qorvo’s stock closed at $62.65, a significant recovery from its 52-week low of $49.46, though still below its 52-week high of $130.99. With a market capitalization of approximately $5.96 billion and a price-to-earnings ratio of 20.5113, Qorvo remains a key player in the semiconductor industry, serving diverse sectors including consumer electronics, smart homes, automotive networks, healthcare, and defense.

Conclusion

This week has been a testament to Qorvo’s enduring strength and strategic acumen in the semiconductor industry. Despite facing challenges and mixed analyst opinions, the company’s strong Q4 earnings, strategic growth plans, and positive outlook from some analysts underscore its potential for continued success. As Qorvo navigates the complexities of the market, its focus on innovation, strategic partnerships, and market leadership positions it well for future growth and resilience.