Revolve Group Inc., an American e-commerce fashion company, continues to make waves in the Consumer Discretionary sector. Listed on the New York Stock Exchange, Revolve Group specializes in offering a diverse range of designer apparel, shoes, and accessories for both men and women. Their product lineup includes jackets, pants, shorts, skirts, sweaters, tops, shoes, and jewelry, all marketed and sold globally through their website, www.revolve.com .

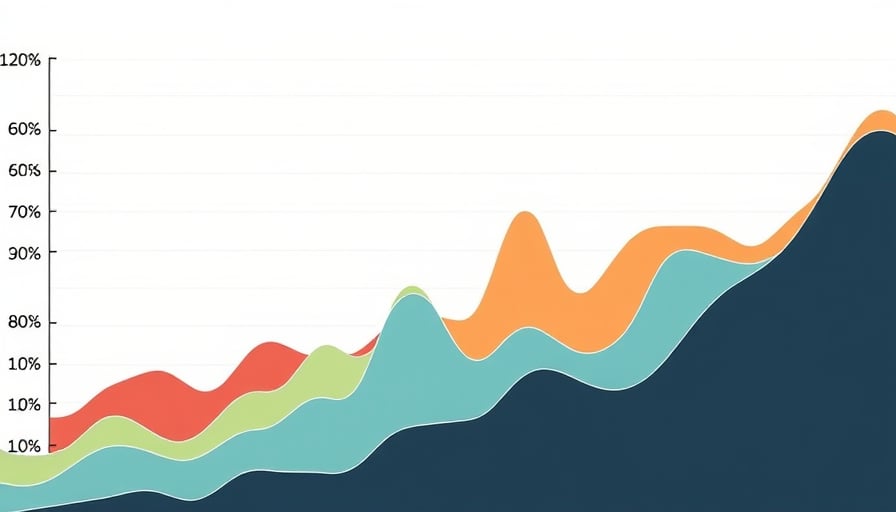

As of the latest trading session on February 19, 2026, Revolve Group’s stock closed at $25.19. This figure is part of a broader trend observed over the past year, where the stock has fluctuated between a low of $16.80 on May 6, 2025, and a high of $31.68 on January 7, 2026. These movements reflect the dynamic nature of the market and the company’s ability to maintain investor interest.

The company’s market capitalization stands at approximately $1.79 billion, underscoring its significant presence in the fashion e-commerce industry. Revolve Group’s valuation multiples further highlight its market positioning. With a price-to-earnings ratio of 32.56, the company is valued at a premium relative to its earnings, suggesting investor confidence in its growth potential. Additionally, the price-to-book ratio of 3.65106 indicates that the market values the company’s assets at a premium, reinforcing its strong market standing.

Despite the absence of recent news, Revolve Group was highlighted as a “Bull of the Day” on February 3, 2026, reflecting positive sentiment among investors. This designation, coupled with the company’s robust financial metrics, paints a picture of a company that is not only thriving in its niche but also poised for continued growth.

In summary, Revolve Group Inc. remains a key player in the fashion e-commerce sector, with a strong market presence and investor confidence. Its strategic focus on designer apparel and accessories, combined with a global reach, positions it well for future success. As the company continues to navigate the ever-evolving retail landscape, its financial health and market positioning suggest a promising trajectory ahead.