Rockwell Automation’s recent trading performance underscores the resilience of the industrial automation sector amid a period of heightened geopolitical activity in East Asia. The company’s share price closed at $368.36 on 30 October 2025, comfortably within the 52‑week range of $215 to $375.02, and the firm’s market capitalization of US$41.4 billion reflects sustained investor confidence.

1. Operational Strength and Market Position

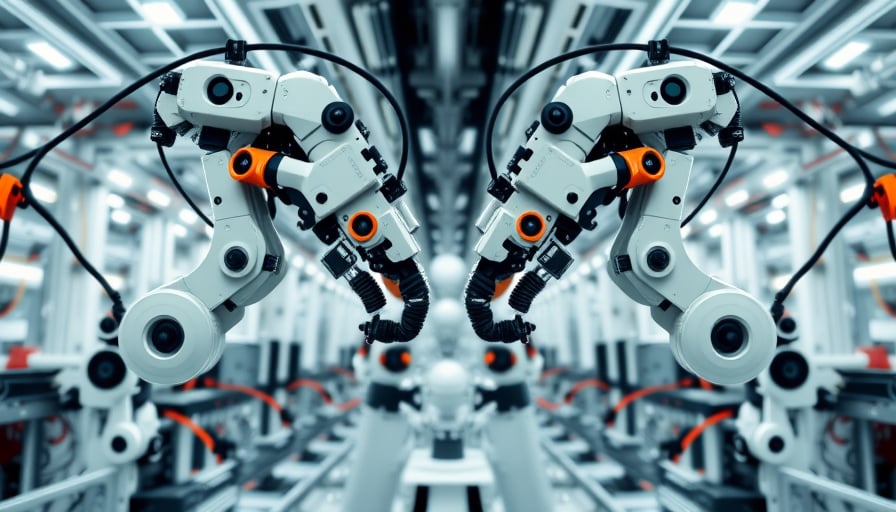

Founded in 1987 and headquartered in Milwaukee, Rockwell Automation has established itself as a global supplier of control systems, motor‑control devices, sensors and industrial control panels. The company’s product portfolio is positioned to benefit from the ongoing digitisation of manufacturing, the shift toward Industry 4.0, and the increasing demand for energy‑efficient production lines.

With a price‑to‑earnings ratio of 38.27, the stock trades at a premium that is justified by its track record of steady revenue growth and a robust balance sheet. The company’s consistent focus on research and development, coupled with strategic acquisitions, has reinforced its competitive advantage in both North America and emerging markets.

2. Geopolitical Context and Its Implications

The past week has seen a flurry of diplomatic activity in the Asia‑Pacific region:

- China–South Korea currency swap – The People’s Bank of China renewed a 400 billion‑yuan swap agreement with the Bank of Korea, signaling a commitment to market stability and liquidity.

- President Xi’s APEC and South Korean visits – Xi Jinping’s return to Beijing after the 32nd APEC Economic Leaders’ Meeting and a state visit to the Republic of Korea (ROK) underscored China’s intent to maintain open, multilateral economic ties.

- Regional diplomatic engagement – Japan’s new Prime Minister, Sanae Takaichi, called for stable ties with China, reinforcing the broader regional consensus on economic cooperation.

These developments collectively suggest a continued emphasis on trade liberalisation and supply‑chain resilience. For Rockwell Automation, stability in the Asia‑Pacific—particularly in South Korea, which hosts a dense cluster of automotive and electronics manufacturers—translates into sustained demand for automation solutions. The currency swap and diplomatic overtures reduce the risk of sudden tariff impositions or supply‑chain disruptions, thereby safeguarding the company’s export revenues and inventory management.

3. Forward‑Looking Outlook

Looking ahead, Rockwell Automation is well‑positioned to capture growth opportunities arising from the region’s investment in smart factories and digital infrastructure. The firm’s strategic partnerships with leading semiconductor and automotive firms in South Korea and Japan provide a foothold to deepen penetration in high‑margin segments.

Key catalysts for the near term include:

- Continued adoption of digital twins and predictive maintenance in Korean and Japanese manufacturing hubs, which drive higher utilization of Rockwell’s software platforms.

- Expansion of renewable energy projects in East Asia, where automation is critical for grid integration and efficiency.

- Potential regulatory incentives under China’s “Made in China 2025” and South Korea’s “Creative Economy” initiatives, which could accelerate demand for advanced control systems.

Investor sentiment, as reflected in the current share price and trading range, indicates confidence that the company will continue to deliver value through innovation, operational excellence, and strategic market expansion. In a landscape where geopolitical tensions can swiftly alter supply dynamics, Rockwell Automation’s robust global presence and diversified client base provide a buffer that should sustain its growth trajectory.