Ross Stores Inc. Faces Market Turbulence Amid Outlook Withdrawal

In a significant development for Ross Stores Inc., the company’s stock experienced a sharp 15% decline on May 23, 2025, following the withdrawal of its fiscal 2025 outlook. This decision, announced in the latest earnings report, was attributed to “heightened macroeconomic and geopolitical uncertainty,” as stated by CEO Jim Conroy. The move underscores the challenges faced by the retail sector amidst fluctuating economic conditions and geopolitical tensions.

Despite the setback in its stock performance, Ross Stores reported a robust first-quarter earnings that exceeded market expectations. The company posted a profit of $479.25 million, or $1.47 per share, surpassing the previous year’s earnings of $487.99 million, or $1.46 per share. This performance was well-received by analysts, who had anticipated earnings per share (EPS) of $1.44, according to forecasts from 20 analysts.

However, the company’s decision to withdraw its annual forecasts was primarily driven by concerns over tariff pressures. Ross Stores highlighted that these tariffs could adversely impact its profitability for the year, reflecting broader challenges within the consumer discretionary sector, particularly for specialty retailers like Ross Stores.

The broader market context also played a role in the company’s stock performance. On the same day, the NASDAQ 100 and S&P 500 indices experienced declines, with the NASDAQ 100 dropping by 1.04% and the S&P 500 by 0.82%. These movements were partly in response to new tariff threats from the U.S. administration, which added to the market’s volatility.

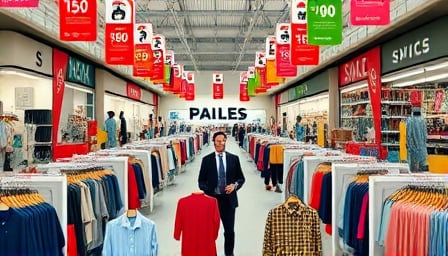

Ross Stores, a leading off-price retailer of apparel and home accessories, operates two distinct brands in the United States. The company’s strategy focuses on offering a wide range of discount-priced name brand and designer apparel, accessories, footwear, and home fashions, catering to a diverse customer base. Despite the current challenges, Ross Stores’ strong Q1 performance and its ability to exceed earnings expectations suggest resilience in its business model.

As Ross Stores navigates through these uncertain times, the company’s leadership will need to closely monitor macroeconomic indicators and geopolitical developments. The withdrawal of its fiscal outlook may be a strategic move to manage investor expectations in the face of unpredictable external pressures. Looking ahead, investors and analysts will be keenly watching for any updates on the company’s strategic direction and how it plans to mitigate the impact of tariffs and other macroeconomic challenges.

In conclusion, while Ross Stores faces immediate headwinds due to macroeconomic and geopolitical uncertainties, its strong Q1 earnings performance provides a foundation for cautious optimism. The company’s ability to adapt to changing market conditions will be crucial in maintaining its position as a leading player in the specialty retail sector.