USD/INR Dynamics Amid a Weakening Dollar and RBI Liquidity Injection

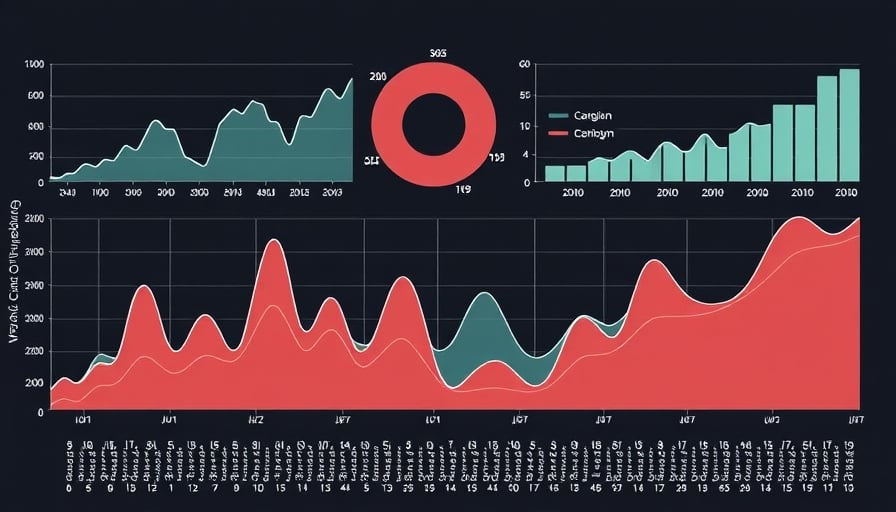

The U.S. dollar’s recent contraction has lifted the Indian rupee on Tuesday, 26 January 2026, as traders respond to a broader depreciation of the greenback. The rupee, which traded at a close of 91.5583 on 22 January, has begun the day in a firmer stance, a trend that follows the dollar’s 0.1 % decline from Friday’s session. This momentum is reinforced by the rupee’s historical high of 91.976 earlier this year and a low of 72.9671 set in May 2025, underscoring the currency’s volatility yet resilience.

Drivers of the Current Upward Tilt

Dollar Weakness The news that the rupee is opening positively amid a weakened dollar is not merely a headline but a reflection of market expectations. The dollar’s drag comes from multiple fronts: a subdued U.S. economic outlook, hawkish policy signals, and a shift in risk sentiment away from the dollar as a safe‑haven. As the dollar falters, the rupee naturally strengthens against it, a classic inverse relationship.

RBI Liquidity Measures The Reserve Bank of India’s recent announcement of a liquidity‑injection package totaling over ₹2.15 lakh crore (approximately $23 billion) has further buoyed sentiment. By buying bonds and injecting durable liquidity, the RBI has signaled its commitment to stabilising the banking system, which in turn reassures investors that credit conditions remain accommodative. This policy stance mitigates concerns about a tightening monetary environment that could have otherwise weighed on the rupee.

Market Context and Sentiment Despite a historic low of 91.96 reached on 23 January—just shy of the 92‑mark that had troubled the rupee earlier in the month—the currency’s recent gains suggest a shift in sentiment. The rupee’s ability to recover from that low is a testament to the combined effect of dollar weakness and RBI’s intervention. Moreover, the rupee’s performance is corroborated by the broader market context: Indian equities and debt markets closed on the Republic Day holiday, but the currency market remained open, allowing traders to react swiftly to global developments.

Implications for Traders and Policymakers

For market participants, the current trend offers an opportunity to capitalize on the rupee’s rally. However, the underlying volatility—highlighted by the 52‑week high and low—remains a cautionary flag. The RBI’s liquidity measures, while supportive, are not a panacea; they must be balanced against inflationary pressures and the need to maintain long‑term financial stability.

Policymakers, on the other hand, must monitor the interaction between the rupee’s exchange rate movements and import costs, particularly for petroleum and electronic goods that are heavily dollar‑priced. A stronger rupee will ease import bills, potentially moderating inflation, but a sudden reversal could strain the trade balance.

Bottom Line

The rupee’s positive start on 26 January is a clear sign that the market is rewarding the dollar’s recent softening while simultaneously recognising the RBI’s decisive liquidity infusion. Traders should stay alert to the currency’s inherent volatility, and policymakers must weigh the dual objectives of maintaining a competitive exchange rate and safeguarding financial system resilience.