Safran SA, a prominent French industrial company headquartered in Paris, continues to be a key player in the aerospace and defense sectors. As of December 4, 2025, the company’s stock closed at 292.9 EUR on the NYSE Euronext Paris, reflecting a position between its 52-week high of 314.1 EUR, achieved on October 23, 2025, and its 52-week low of 190.7 EUR, recorded on April 6, 2025. This trading range underscores a period of moderate volatility for Safran’s stock, indicative of the dynamic nature of the aerospace and defense industries.

With a market capitalization of approximately 122.1 billion EUR, Safran’s financial metrics reveal a robust valuation. The company’s price-to-earnings (P/E) ratio stands at 28.56, suggesting that investors are willing to pay nearly 28.5 times the company’s earnings, a testament to the market’s confidence in Safran’s growth prospects and operational efficiency. Additionally, the price-to-book (P/B) ratio of 9.32 indicates that the market values the company significantly higher than its book value, reflecting strong investor sentiment and the perceived intrinsic value of Safran’s assets and capabilities.

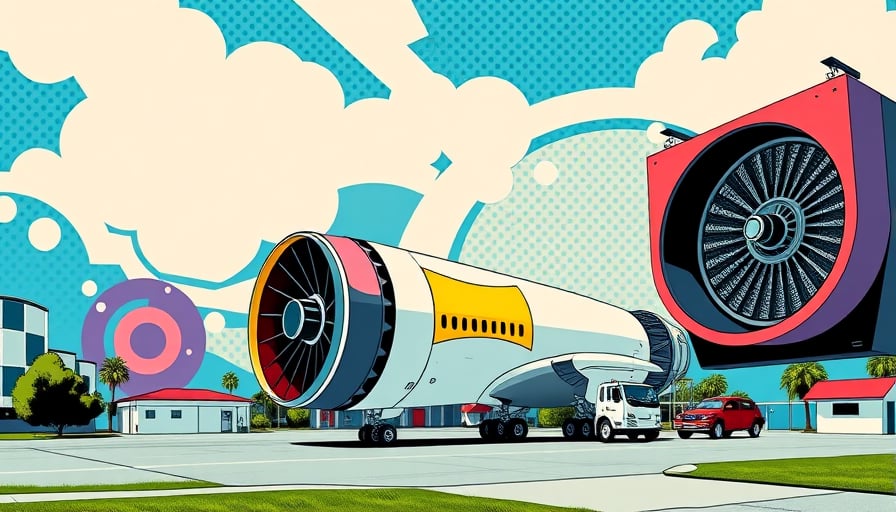

As the United Kingdom’s third-largest civil aerospace firm, Safran’s portfolio is diverse and comprehensive, encompassing engines for airplanes and helicopters, launch vehicles, landing and braking systems, nacelles, onboard electrical systems, optics, avionics, launcher propulsion, biometric equipment, explosives detection, and trace analysis systems. This extensive range of products and services positions Safran as a global leader in the aviation and defense industries, catering to a wide array of customer needs across the globe.

Despite the absence of new press releases as of December 3, 2025, Safran’s strategic focus on innovation and technological advancement remains evident. The company’s commitment to delivering cutting-edge solutions in aerospace and defense is likely to continue driving its growth trajectory. Investors and industry analysts will be closely monitoring Safran’s future developments, particularly in light of its strong financial performance and strategic positioning within the industry.

In summary, Safran SA’s current financial standing and market valuation reflect a company that is well-regarded by investors and positioned for sustained success in the aerospace and defense sectors. With its comprehensive product offerings and strategic focus on innovation, Safran is poised to maintain its leadership role in the global market.