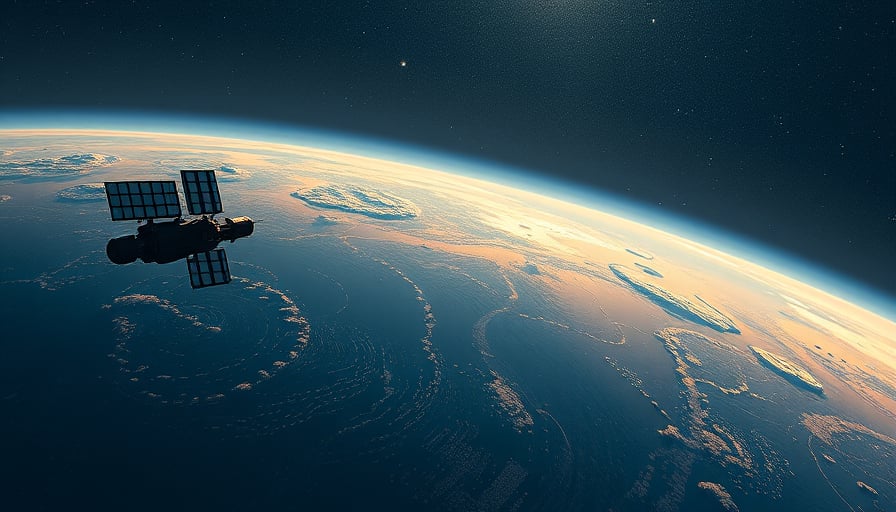

Satellogic Inc., a pioneering company based in Montevideo, Uruguay, has been making significant strides in the realm of earth observation satellites. Specializing in the design, manufacturing, and operation of these satellites, Satellogic aims to re-map the entire planet with high-frequency and high-resolution data. This ambitious endeavor is not just about technological advancement; it is about democratizing access to geospatial data, enabling clients worldwide to harness planetary-scale insights for real-world applications.

In its third-quarter financial results released on November 10, 2025, Satellogic provided a snapshot of its current financial standing. The company’s stock, which had experienced considerable fluctuations over the past year, closed at $2.06 on the day of the announcement. This figure is part of a broader narrative of volatility, with the stock reaching a 52-week high of $5.12 on February 10, 2025, and a low of $1.255 on November 20, 2025. Such fluctuations underscore the challenges and opportunities inherent in the rapidly evolving satellite technology sector.

The financial metrics reveal a company navigating a challenging earnings environment. With a price-to-earnings ratio of -1.95 and a price-to-book ratio of -4.90564, both negative, Satellogic’s valuation multiples suggest that the company is currently operating at a loss relative to its market valuation. These figures indicate that investors are pricing the company below its book value and earnings, a common scenario for firms in the growth phase, particularly those in high-tech industries like satellite imaging.

Despite these financial challenges, Satellogic’s mission remains clear and compelling. By democratizing access to geospatial data, the company is not only advancing its technological capabilities but also empowering a diverse range of clients to leverage this data for various applications. From agriculture and environmental monitoring to urban planning and disaster response, the potential uses of high-resolution, high-frequency satellite data are vast and varied.

As Satellogic continues to expand its satellite constellations, the company is poised to play a crucial role in the future of earth observation. The ability to provide real-time, high-resolution data on a global scale has the potential to transform industries and drive innovation across multiple sectors. While the path to profitability may be challenging, the long-term vision of Satellogic is one of significant impact and transformation.

In conclusion, Satellogic Inc. stands at the forefront of a technological revolution in earth observation. Despite the financial hurdles reflected in its current valuation multiples, the company’s commitment to democratizing geospatial data and its potential to drive real-world outcomes with planetary-scale insights remain its most compelling attributes. As Satellogic continues to navigate the complexities of the satellite technology market, its role in shaping the future of earth observation is likely to grow, offering both challenges and opportunities for investors and clients alike.