Serabi Gold PLC, a company operating within the materials sector, specifically in metals and mining, has recently reported significant developments in its operations and financial performance. The company, listed on the London Stock Exchange, is primarily focused on its Palito Gold Mine located in the Tapajos region of northern Brazil.

In the third quarter of 2025, Serabi Gold Ltd. achieved a record quarterly production of 12,090 gold ounces. This milestone is part of the company’s broader performance over the first nine months of the year, as detailed in its most recent interim results. The impressive production figures underscore the company’s operational efficiency and its ability to capitalize on its mining assets.

Further enhancing its strategic position, Serabi Gold Ltd. has filed an NI 43-101 technical report for its Palito Complex holdings. This report is a critical component in the mining industry, providing a detailed and standardized assessment of the mineral resources and reserves. Additionally, the company has updated its exploration data for 2025 brownfield drilling activities at both the Palito and Coringa sites. These updates reflect ongoing efforts to expand and optimize its resource base, ensuring sustained production and growth.

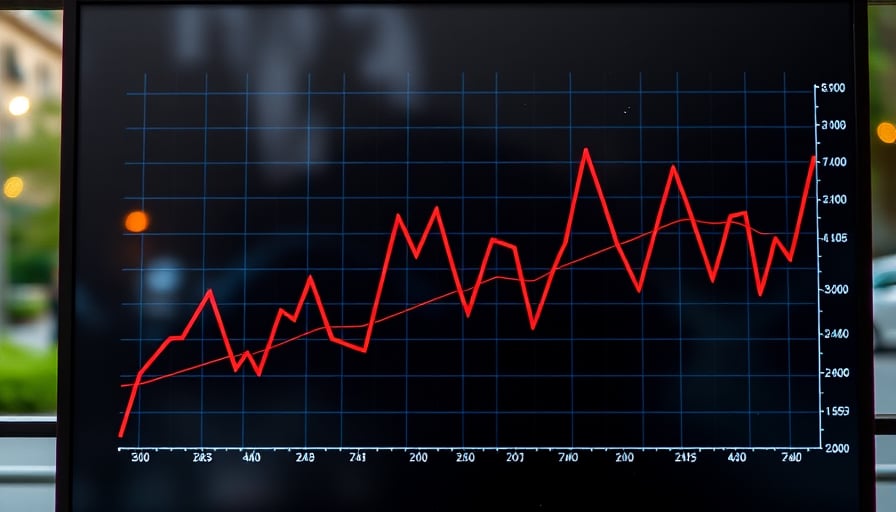

Financially, Serabi Gold PLC’s shares have shown robust performance on the market. As of January 22, 2026, the share price closed at 359 GBX, trading near its 52-week high of 365 GBX. This is a significant recovery from the 52-week low of 120 GBX recorded on April 6, 2025. The current price-to-earnings ratio stands at 8.26, while the price-to-book ratio is 2.167. These valuation metrics suggest that the market is recognizing the company’s recent production achievements and its proactive exploration activities.

Overall, Serabi Gold PLC’s recent operational successes and strategic initiatives position it well within the metals and mining industry. The company’s focus on enhancing its resource base and maintaining high production levels is likely to continue driving its growth and market valuation in the foreseeable future.