ATS Corp: A Strategic Acquisition by SGS

In a bold move that has sent ripples through the industrial sector, SGS, a global leader in testing, inspection, and certification, has announced its acquisition of ATS Corporation for a staggering $1.33 billion. This strategic acquisition, confirmed on July 2, 2025, underscores SGS’s commitment to expanding its footprint in the industrial automation space, a sector that is increasingly pivotal in today’s manufacturing landscape.

ATS Corporation: A Brief Overview

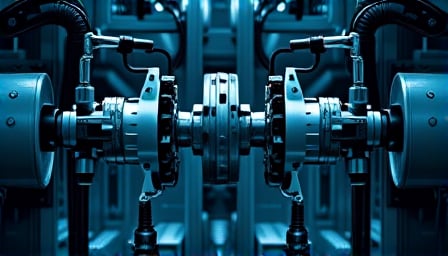

ATS Corporation, listed on the Toronto Stock Exchange, is a renowned custom engineer and producer of industrial automated manufacturing systems. Catering to a diverse range of industries including life sciences, chemicals, consumer products, electronics, food, beverage, transportation, energy, and oil and gas, ATS has carved a niche for itself by offering value-added services such as pre-automation and after-sales support. Despite facing a challenging year, with its stock price dipping to a 52-week low of CAD 29.81 on April 8, 2025, the company has shown resilience, closing at CAD 43.91 on July 2, 2025.

The Acquisition: A Game Changer

The acquisition by SGS is not just a financial transaction; it’s a strategic alignment that promises to redefine the landscape of industrial automation. ATS’s expertise in custom engineering and its robust portfolio of automated manufacturing systems are expected to complement SGS’s existing capabilities, thereby enhancing its service offerings and expanding its market reach. This move is anticipated to create synergies that will drive innovation, efficiency, and growth for both entities.

Market Reaction

The news of the acquisition has been met with enthusiasm in the financial markets, with SGS shares experiencing a notable rise. This positive market reaction reflects investor confidence in SGS’s strategic vision and its ability to integrate ATS’s capabilities to unlock new growth avenues. The acquisition is seen as a testament to SGS’s proactive approach in strengthening its position in the industrial sector, amidst a rapidly evolving technological landscape.

Looking Ahead

As ATS Corporation becomes part of the SGS family, stakeholders are keenly watching how this integration unfolds. The focus will be on how SGS leverages ATS’s technological prowess and industry expertise to enhance its service offerings and drive innovation. This acquisition is not just a win for SGS but also a significant milestone for ATS, promising new opportunities and a broader platform to showcase its capabilities.

In conclusion, the acquisition of ATS Corporation by SGS is a strategic move that highlights the growing importance of industrial automation in the global manufacturing sector. It underscores the need for companies to adapt, innovate, and collaborate to stay ahead in a competitive landscape. As this integration progresses, it will be interesting to see how it shapes the future of industrial automation and the broader industrial sector.