SHANDONG HIKING INTERNATIONAL CO., LTD.: A Rollercoaster Ride in the Trading Sector

In the ever-volatile world of trading companies, SHANDONG HIKING INTERNATIONAL CO., LTD. stands as a testament to the unpredictable nature of the industry. As a key player in the industrials sector, this company has navigated through turbulent waters, marked by significant fluctuations in its stock performance. With its primary listing on the Shanghai Stock Exchange, SHANDONG HIKING INTERNATIONAL has been under the watchful eyes of investors and analysts alike, who have witnessed its share price dance between highs and lows with remarkable volatility.

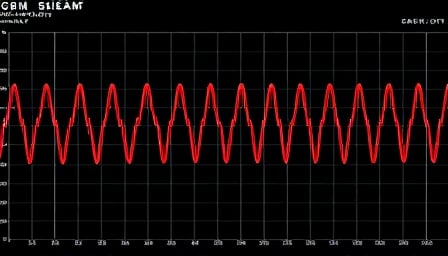

As of April 29, 2025, the company’s close price stood at 5.69 CNY, a figure that, while seemingly stable, belies the tumultuous journey it has undergone over the past year. The 52-week high of 6.55 CNY, reached on April 15, 2025, paints a picture of a company that once soared to impressive heights. However, this peak is a stark contrast to the 52-week low of 3.44 CNY, recorded on August 28, 2024, highlighting a period of significant distress and uncertainty for the company and its stakeholders.

This rollercoaster ride in the stock market is not just a tale of numbers but a reflection of the broader challenges and opportunities within the trading companies and distributors industry. SHANDONG HIKING INTERNATIONAL’s journey underscores the critical importance of strategic agility and resilience in the face of market volatility. The company’s ability to navigate through these highs and lows speaks volumes about its operational strategies and market positioning.

Investors and market watchers are left pondering the future trajectory of SHANDONG HIKING INTERNATIONAL. Will the company leverage its experiences from the past year to stabilize and grow its market presence? Or will it continue to be at the mercy of the unpredictable winds of the trading sector? Only time will tell, but one thing is certain: SHANDONG HIKING INTERNATIONAL CO., LTD. remains a compelling case study in the dynamics of the trading industry, offering valuable lessons on the importance of adaptability and strategic foresight in an ever-changing market landscape.