Shanghai AtHub Co. Ltd – Equity Change and Market Activity

Equity Change Notification On 9 February 2026 the Shanghai Stock Exchange listed company Shanghai AtHub Co., Ltd. (stock code 603881) issued a Indicative Announcement concerning the change in equity of shareholders holding more than 5 % of the company. The announcement, filed under number 2026‑002, stated that the total proportion of shares held by such shareholders would decrease from 11.67 % to 10.57 %. The change reflects a reduction in the holdings of major shareholders, which may indicate a divestment or redistribution of shares. The announcement also noted that the direction of the change was a decrease.

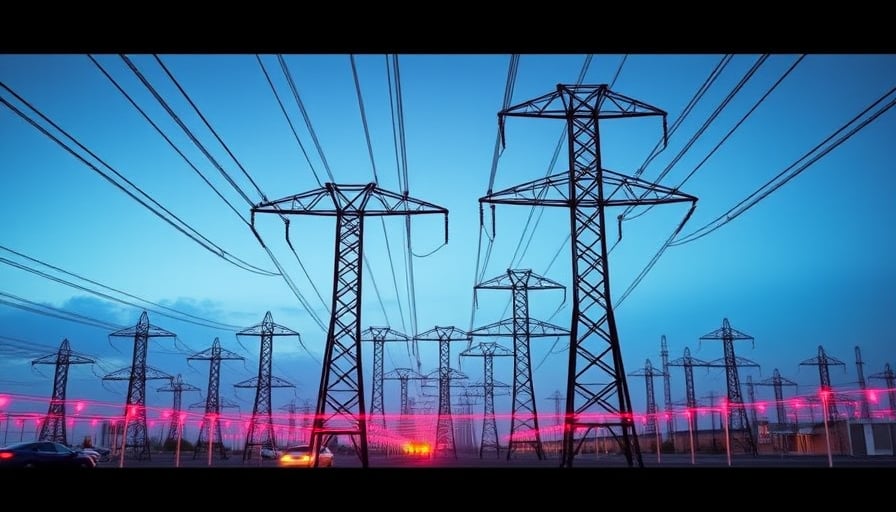

Market Reaction to Data‑Center and Compute‑Power Themes During the same period, the broader market saw heightened activity in the compute‑power and data‑center sectors.

- On 12 February 2026, several “算力租赁” (compute‑leasing) stocks opened higher, with 美利云 reaching its daily limit and 数据港 (Shanghai AtHub) following the rally.

- Earlier, on 10 February 2026, the 算力板块 (compute‑power segment) experienced a surge, with the cloud‑computing ETF 汇添富 posting a second consecutive rise. Several constituent stocks, including 数据港, increased by more than 5 %.

- The momentum was supported by reports of a recent AI model launch (Seedance 2.0) and policy statements from the State Administration of the Industrial and Information Technology Ministry encouraging investment in AI and compute‑power infrastructure.

Capital Flow Context

- On 10 February 2026, total “特大单” (large‑order) net outflows amounted to 135.34 亿元, yet individual large‑order inflows were observed in sectors such as 传媒, 计算机, and IDC.

- 数据港 was reported as a net outflow in both the 10 February and 9 February main‑market fund‑flow summaries, with outflows of 8.90 亿元 and 8.90 亿元 respectively.

- Conversely, the 9 February market‑wide net inflow of 261.26 亿元 was led by semiconductor and photovoltaic stocks; 数据港 did not feature among the top inflow or outflow stocks.

Financial Snapshot (as of 9 February 2026)

- Close price: 41.9 CNY

- 52‑week high: 43.5 CNY

- 52‑week low: 21.1917 CNY

- Market capitalization: 30.07 billion CNY

- Price‑to‑earnings ratio: 206.85

The high P/E suggests that the market values the company’s future growth potential more than its current earnings, which aligns with its role as a data‑center provider in the rapidly expanding cloud‑computing sector.

Implications The shareholder equity reduction may prompt analysts to reassess the ownership structure and its influence on corporate governance. Meanwhile, the strong performance of compute‑power related stocks indicates sustained investor confidence in the data‑center and AI infrastructure market, likely benefiting Shanghai AtHub’s revenue prospects.