Shanghai Hanbell Precise Machinery Co Ltd: A Closer Look at the Industrial Giant

In the bustling industrial landscape of China, Shanghai Hanbell Precise Machinery Co., Ltd. stands as a formidable player, specializing in the production of screw compressors. However, beneath the surface of its industrial prowess lies a narrative of fluctuating fortunes and market challenges that demand scrutiny.

As of August 14, 2025, Shanghai Hanbell’s stock closed at 19.71 CNH on the Shenzhen Stock Exchange, a significant drop from its 52-week high of 23.38 CNH on March 10, 2025. This decline raises questions about the company’s strategic direction and market resilience. Investors and analysts alike are left pondering: what factors have contributed to this downward trajectory?

With a market capitalization of 9.58 billion CNH, Shanghai Hanbell remains a substantial entity within the machinery sector. Yet, its price-to-earnings ratio of 11.49 suggests a cautious optimism at best. This metric, while not alarmingly high, indicates that the market may be tempering its expectations for the company’s future growth.

The company’s journey through the past year has been marked by volatility. The 52-week low of 15.61 CNH on September 22, 2024, underscores the challenges faced by Shanghai Hanbell in maintaining its market position. What are the underlying issues that have led to such fluctuations? Is it a matter of internal inefficiencies, or are external market forces at play?

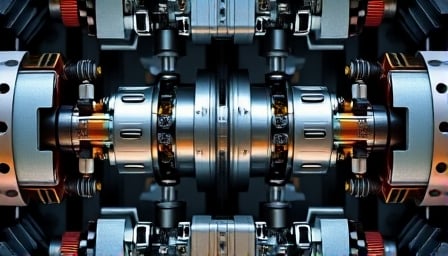

Shanghai Hanbell’s core business revolves around screw compressors, a niche yet critical component in various industrial applications. The demand for such machinery is inherently tied to broader economic trends, including industrial output and energy consumption. As global markets grapple with economic uncertainties, Shanghai Hanbell’s fortunes are inevitably linked to these macroeconomic factors.

Moreover, the competitive landscape in the machinery sector is fierce. Shanghai Hanbell must navigate not only domestic rivals but also international players who are constantly innovating and expanding their market share. How is the company positioning itself to stay ahead in this cutthroat environment? Are its product offerings and technological advancements sufficient to meet the evolving demands of the industry?

In conclusion, while Shanghai Hanbell Precise Machinery Co., Ltd. remains a key player in the industrial machinery sector, its recent performance raises critical questions about its future trajectory. Investors and stakeholders must closely monitor the company’s strategic initiatives and market conditions to gauge its potential for recovery and growth. The road ahead for Shanghai Hanbell is fraught with challenges, but it also presents opportunities for those willing to navigate the complexities of the industrial landscape.