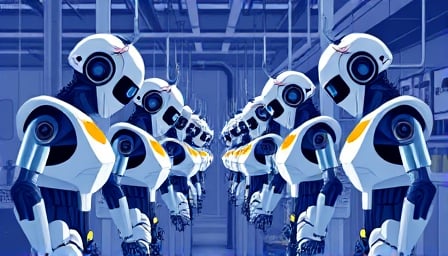

Shanghai Mechanical and Electrical Industry Co Ltd: A Surge in Investor Confidence Amidst Robotic Revolution

In a dramatic turn of events, Shanghai Mechanical and Electrical Industry Co Ltd, a key player in the machinery sector, has seen its stock price soar to a 52-week high, closing at 23.96 CNH on July 23, 2025. This surge is part of a broader market enthusiasm surrounding the burgeoning robotics sector, with the company’s stock hitting a trading halt due to significant price increases.

Market Dynamics and Investor Sentiment

The recent spike in Shanghai Mechanical’s stock is not an isolated incident but part of a larger trend fueled by the robotics concept gaining momentum. On July 25, 2025, the company’s stock was halted after a substantial increase, reflecting a broader market trend where companies like 横河精密 and 涛涛车业 saw their stocks rise by over 10%. This surge is attributed to the robotics sector’s growing appeal, further amplified by Tesla CEO Elon Musk’s announcement of the upcoming release of the Optimus humanoid robot prototype by the end of 2025, with mass production slated for 2026.

Financial Health and Market Position

Shanghai Mechanical, with a market capitalization of 20.12 billion CNH, operates in a competitive landscape, focusing on elevators, printing and packaging machinery, and air conditioners. Despite the recent stock price surge, the company’s Price Earnings Ratio stands at 25.1, indicating a potentially overvalued stock in the eyes of some investors. However, the company’s robust financial maneuvers, including a significant financing buy-in of 3.139 billion CNH on July 22, 2025, underscore a strong investor confidence and a bullish market sentiment.

The Role of Financing in Market Movements

The company’s recent financial activities, particularly the financing buy-in, which accounted for 33.39% of the day’s total buy-in amount, highlight a strategic move to bolster its market position. With a financing balance of 5.89 billion CNH, Shanghai Mechanical’s financial strategy appears to be a calculated effort to capitalize on the current market dynamics and investor enthusiasm towards the robotics sector.

Conclusion: A Strategic Position in a Transformative Era

Shanghai Mechanical and Electrical Industry Co Ltd’s recent stock performance and financial strategies reflect a company at the forefront of the industrial and robotics revolution. With the market’s eyes set on the future of robotics, as evidenced by the anticipation surrounding Tesla’s Optimus, Shanghai Mechanical is strategically positioned to leverage this momentum. However, investors should remain vigilant, considering the company’s high Price Earnings Ratio and the volatile nature of market trends driven by technological advancements. As the robotics sector continues to evolve, Shanghai Mechanical’s ability to adapt and innovate will be crucial in maintaining its market position and investor confidence.