In the bustling world of the Shanghai Stock Exchange, a notable development has emerged within the materials sector, particularly impacting companies involved in the production of photolithography resins. On July 7, 2025, a series of reports highlighted a significant rebound in the photolithography resin concept, with Pritle Technology Co., Ltd. experiencing a surge to its daily price limit. This movement was not isolated, as several other companies, including Guangxin Materials, Dongtai Technology, Jiurixin Materials, Qicai Chemical, Shiming Technology, and Hongbao Li, also saw their stocks rise in tandem.

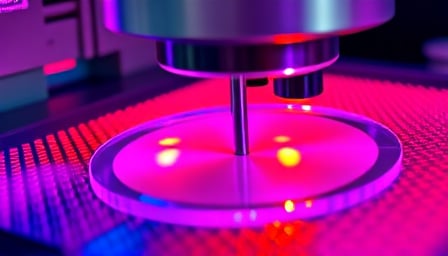

The catalyst behind this market activity appears to be the sustained growth in demand from the downstream PCB (Printed Circuit Board) industry. According to insights from Bai Chuan Ying Fu, a notable industry analyst, this increased demand has led to a rise in the prices of various grades of domestic photolithography resins. Specifically, the 907 grade resin saw its reference ex-factory price climb to 88 yuan per kilogram, marking a 2 yuan increase from the previous month and a significant 19 yuan rise since the beginning of the year.

While Pritle Technology Co., Ltd. was at the forefront of this surge, the ripple effect across related companies underscores the interconnected nature of the materials sector, particularly within the realm of chemicals and advanced materials. Among these companies, Sichuan EM Technology Co., Ltd., a key player based in Mianyang, China, specializes in the development, production, and sale of insulation materials, functional polymer materials, and related fine chemical products. Although not directly mentioned in the recent news, the company’s focus on electrical polyester film, electrical polypropylene film, electrical mica tape, flexible laminates, and rigid laminated sheets positions it within the broader narrative of materials innovation and demand.

As of July 3, 2025, Sichuan EM Technology Co., Ltd. was trading at a close price of 10.66 yuan, matching its 52-week high, a notable recovery from its 52-week low of 6.12 yuan recorded on August 20, 2024. With a market capitalization of approximately 8.66 billion yuan and a price-to-earnings ratio of 39.6626, the company’s financial health and market position reflect its resilience and potential for growth within the dynamic materials sector.

This recent market activity not only highlights the volatility and opportunities within the photolithography resin concept but also underscores the broader trends affecting the materials and chemicals industry. As companies like Sichuan EM Technology Co., Ltd. continue to innovate and adapt to market demands, the sector remains a critical component of the global supply chain, driving advancements in technology and manufacturing.