Shannon Semiconductor Technology Co Ltd: A Snapshot of Recent Performance and Overview

Shannon Semiconductor Technology Co Ltd, a prominent player in the semiconductor industry, has recently been in the spotlight due to its performance on the Shenzhen Stock Exchange. As of June 16, 2025, the company’s close price stood at 34.7 CNY, reflecting a notable position within the market. This figure is part of a broader financial narrative, with the company’s 52-week high reaching 45.19 CNY on March 17, 2025, and a low of 22.92 CNY on September 23, 2024. These fluctuations highlight the dynamic nature of the semiconductor sector and the company’s resilience in navigating market challenges.

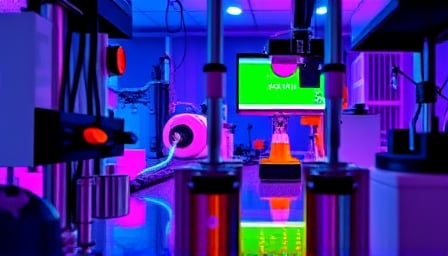

With a market capitalization of 14,614,651,640 CNY, Shannon Semiconductor Technology Co Ltd holds a significant presence in the industrials sector, specifically within the machinery industry. The company’s focus on the design, development, production, and marketing of customized integrated circuits and semiconductor components positions it as a key innovator in the field. Their product range includes both digital and analog integrated circuits, alongside specialized components tailored for diverse applications.

Founded in 2000, Shannon Semiconductor Technology Co Ltd has established its main operations in Ningguo, China. The company’s commitment to innovation and quality has been a cornerstone of its strategy, enabling it to maintain a competitive edge in the rapidly evolving semiconductor landscape. The company’s website, www.shannansemicon.com , serves as a portal for stakeholders to explore its offerings and corporate ethos.

Financially, the company’s price-to-earnings ratio stands at 52.3692, indicating investor confidence in its growth prospects and profitability. This ratio, while high, is reflective of the company’s strong market position and the anticipated future earnings growth within the semiconductor industry.

In summary, Shannon Semiconductor Technology Co Ltd continues to be a significant entity within the semiconductor sector, driven by its innovative product offerings and strategic market positioning. As it navigates the complexities of the global market, the company remains focused on leveraging its strengths to sustain growth and deliver value to its stakeholders.