Shengyi Electronics Co Ltd: A Critical Analysis Amidst Market Dynamics

In the ever-evolving landscape of the Chinese electronics sector, Shengyi Electronics Co Ltd stands as a noteworthy entity, trading on the Shanghai Stock Exchange. As of August 13, 2025, the company’s close price was recorded at 53.52 CNY, with a 52-week high of 57.28 CNY and a low of 16.57 CNY. Despite a staggering market capitalization of 44,519,070,148 CNY, the company’s price-to-earnings ratio of 86.07311 raises eyebrows, suggesting a potentially overvalued stock in the eyes of some investors.

Market Trends and Competitive Landscape

The recent market trends have been nothing short of a rollercoaster, with the Shanghai Composite Index climbing by 1.7% to 3696.77 points, and the Shenzhen Component Index surging by 4.55% to 11634.67 points. Amidst this bullish market, Shengyi Electronics has seen its share price increase by 15.19% over the past week and 23.40% over the past month, culminating in a year-to-date gain of 144.57%. This performance is particularly impressive when juxtaposed with its competitors in the electronics sector, such as Xingzheng Technology, which has seen a year-to-date increase of 144.57%, and other industry players like Xidun Electronics and Guanghe Technology, which have also posted significant gains.

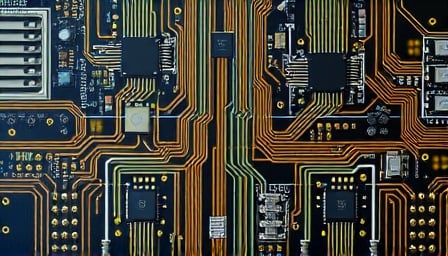

The PCB Boom and Its Implications

A pivotal development in the electronics sector is the surge in demand for high-end PCB (Printed Circuit Board) products, fueled by the AI server boom. This has led to a “stopping rise” in the PCB sector, with stocks like Zhongfu Circuit and Guojia Fuzhi hitting their 20-day highs. However, not all is rosy in the PCB landscape. The recent performance of CPO (Chip-on-Photonics) stocks, particularly Taiqin Optoelectronics, which saw a dramatic drop of 12.99% after a significant pre-drop surge, serves as a cautionary tale of the volatility inherent in tech stocks.

Financial Performance and Investor Sentiment

The financial performance of companies within the electronics sector, including Shengyi Electronics, has been a focal point for investors. The sector has witnessed a continuous increase in net profits for four consecutive quarters, with companies like Neweisen and Zhongji Xuchuang in the CPO sector, and Huadian Shares and Shengyi Electronics in the PCB sector, leading the charge. This trend underscores the robustness of the electronics sector, buoyed by technological advancements and market expansion.

Dividend Distribution: A Sign of Confidence?

In a move that signals confidence in their financial health, several A-share companies, including giants like China Mobile and China Telecom, have announced substantial dividend distributions, with total dividends exceeding 1000 billion CNY. This gesture not only rewards shareholders but also reflects the companies’ optimism about their future earnings potential.

Conclusion: A Critical Perspective

While Shengyi Electronics and its peers in the electronics sector have shown remarkable resilience and growth, the high price-to-earnings ratio and the volatile nature of tech stocks warrant a cautious approach. Investors are advised to conduct thorough due diligence, keeping an eye on market trends, competitive dynamics, and the broader economic landscape. As the electronics sector continues to evolve, Shengyi Electronics’ ability to innovate and adapt will be crucial in maintaining its competitive edge and delivering value to its shareholders.