Shengyi Technology Co Ltd: A Financial Deep Dive

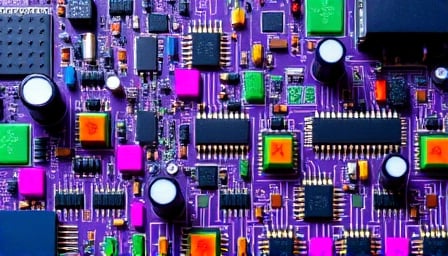

In the ever-evolving landscape of the Information Technology sector, Shengyi Technology Co Ltd stands as a notable player. Listed on the Shanghai Stock Exchange, this company specializes in manufacturing and marketing electronic components, including copper clad plates, insulating laminated sheets, and high multilayer circuit boards. Despite its diverse product range, the company’s financial performance has been a mixed bag, raising eyebrows among investors and analysts alike.

Financial Snapshot

As of July 13, 2025, Shengyi Technology’s close price stood at 32.91 CNH, with a 52-week high of 35.38 CNH and a low of 16.47 CNH. The market capitalization was a hefty 82.96 billion CNH. However, the price-to-earnings ratio of 43.24 signals a potentially overvalued stock, suggesting that investors are paying a premium for future earnings growth that may or may not materialize.

Market Movements and Sector Performance

The broader market context provides a backdrop against which Shengyi Technology’s performance can be assessed. On July 15, 2025, the Shanghai Composite Index (Shanghai Index) saw a slight decline of 0.42%. Despite this, 33 stocks, including Shengyi Technology, hit historical highs. This anomaly in a declining market underscores the selective investor confidence in certain stocks, possibly driven by sector-specific news or company fundamentals.

The Information Technology sector, particularly electronic equipment, instruments, and components, has seen a concentration of stocks reaching new highs. This trend is indicative of the sector’s resilience and potential for growth, despite broader market fluctuations. Shengyi Technology, with its focus on electronic components, is well-positioned to capitalize on this trend, provided it can navigate the challenges inherent in the sector.

Competitive Landscape and Industry Dynamics

The electronic components industry is fiercely competitive, with companies vying for market share through innovation, cost leadership, and strategic partnerships. Shengyi Technology’s operation of house loans is an interesting diversification strategy, potentially providing a steady income stream outside its core business. However, the company must ensure that this diversification does not dilute its focus on the core competencies that have driven its success in the electronic components market.

Looking Ahead

As Shengyi Technology Co Ltd navigates the complexities of the Information Technology sector, several factors will be critical to its success. The company must continue to innovate, keeping pace with technological advancements and changing consumer demands. Additionally, strategic partnerships and acquisitions could provide new growth avenues and strengthen its market position.

In conclusion, Shengyi Technology Co Ltd presents a mixed bag of opportunities and challenges. While its market capitalization and sector positioning are strong, the high price-to-earnings ratio and the competitive nature of the electronic components industry pose significant risks. Investors and stakeholders will be watching closely to see how the company leverages its strengths and navigates the challenges ahead.