Shengyi Technology Co Ltd: Financial Overview and Market Movements

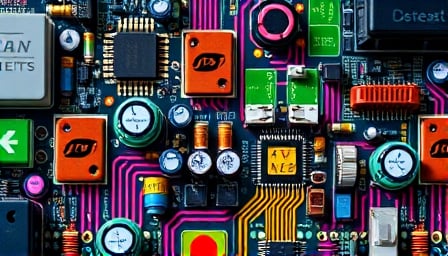

Shengyi Technology Co., Ltd., a prominent player in the Information Technology sector, specializes in manufacturing and marketing electronic components. The company’s product range includes copper clad plates, insulating laminated sheets, double-sided circuit boards, high multilayer circuit boards, and more. Additionally, Shengyi Technology operates in the house loans sector. Listed on the Shanghai Stock Exchange, the company’s primary exchange currency is CNH.

As of July 24, 2025, Shengyi Technology’s close price stood at 38.05 CNH, with a 52-week high of 39.97 CNH on July 21, 2025, and a 52-week low of 16.47 CNH on September 19, 2024. The company boasts a market capitalization of 94,380,000,000 CNH and a price-to-earnings ratio of 49.2.

Market Dynamics and Investment Trends

Recent financial news highlights significant investment trends in the technology sector, particularly in companies involved in the production of electronic components. Notably, foreign investment funds have shown a keen interest in companies like Shengyi Technology, which are integral to the technology manufacturing chain.

A report from stock.eastmoney.com dated July 27, 2025, reveals that foreign investment funds, including Morgan Stanley, BlackRock, and others, have been actively adjusting their portfolios. These funds have been focusing on companies that are central to the technology manufacturing chain, such as those producing copper clad plates and circuit boards. This trend underscores a strategic shift towards assets that offer both value and growth potential.

Key Investments and Market Sentiment

The report further details that funds like Lufax and Union Investment have been particularly aggressive in their investment strategies, with significant increases in stock market value. Companies like Xinyisheng and Shenghong Technology have become focal points for these investments, indicating a broader market consensus on their potential.

Moreover, the report highlights that while some funds have taken a more conservative approach, focusing on core assets like Ningde Times and East Mountain Precision, the overall sentiment leans towards investing in technology-centric assets. This is evident from the substantial investments in companies that are part of the high-demand segments of the technology manufacturing chain.

Conclusion

Shengyi Technology Co., Ltd. remains a key player in the electronic components industry, with significant interest from foreign investment funds. The company’s strategic position in the technology manufacturing chain, coupled with its robust market performance, makes it an attractive option for investors looking for growth in the technology sector. As the market continues to evolve, Shengyi Technology’s role in the industry is likely to become even more pronounced.