Shenzhen Kinwong Electronic Co. Ltd.: A Case Study in Over‑valuation and Missed Opportunities

Shenzhen Kinwong Electronic (SH603228), a listed manufacturer of printed circuit boards (PCBs) headquartered on Haide 3rd Road in Shenzhen, has slipped into the doldrums of the Chinese technology market. With a market cap of 69.1 billion CNY and a price‑to‑earnings ratio of 54.89, the company’s shares are priced for growth that has yet to materialise. The last closing price of 77.19 CNY, set on 2025‑10‑27, sits 14.9 % below the 52‑week high of 81.41 CNY achieved on 2025‑09‑22, while still standing a staggering 63 % above the 52‑week low of 23.69 CNY recorded on 2024‑11‑24.

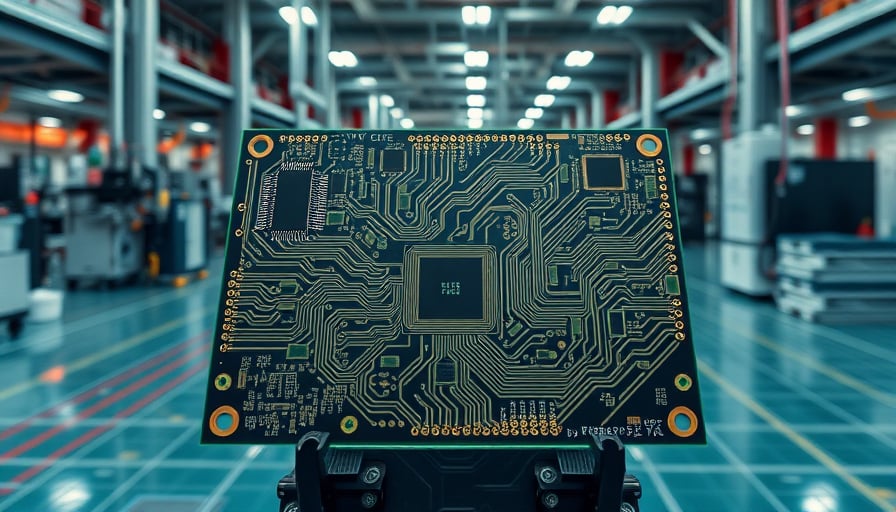

The Core Business in a Stagnant Market

Kinwong specialises in the design, production and sale of a range of PCBs—double‑sided, aluminum, four‑layer and specialised circuits. These components form the backbone of electronics manufacturing, yet the company’s product mix lacks the differentiation that could justify its lofty valuation. In a market where economies of scale and supply‑chain efficiency dictate margins, Kinwong’s modest product range and heavy reliance on the broader PCB industry expose it to commoditisation risks.

Financial Performance: A Worrying Decline

The company’s recent earnings disclosures paint a bleak picture. While the Shenzhen‑based PCB manufacturer is not mentioned explicitly in the latest quarterly reports of prominent AI‑focused funds, the broader market sentiment offers clues. The AI‑driven “front‑line” funds such as the Front‑Sea Value Strategy Stock (005328) and Guangfa Sci‑Tech Theme Flexible Allocation Hybrid (501078) reported impressive profits of 12.0157 million CNY and 133.4 million CNY respectively in Q3 2025, alongside net‑asset growth rates of 24.81 % and 23.6 %. These funds have increased exposure to high‑growth “AI” and “domestic computing power” sectors, signalling investor confidence in technological advancement.

By contrast, Kinwong’s share price has been stagnating, and its high P/E ratio indicates that the market is pricing in future growth that is currently unsubstantiated. The company has not demonstrated any significant move toward high‑margin sectors such as AI hardware or advanced semiconductor manufacturing that could lift its earnings.

Market Sentiment and Funding Dynamics

On 2025‑10‑28, the overall financing balance in the Shenzhen market surged by 67.06 billion CNY, marking the third consecutive day of rising leverage. Yet, even amid this inflow, only 45 stocks received net financing above 1 billion CNY, none of which included Kinwong. The lack of fresh capital inflows into Kinwong underscores a waning confidence among investors.

Moreover, the “Tiger List” analysis of 63 stocks on 2025‑10‑28 identified only a handful of names, such as Jingwang Electronic and Fangda Carbon, as receiving significant net purchases. Kinwong did not appear on this list, further suggesting that institutional and retail money are steering clear of its stock.

Strategic Direction: The Missing Link

The company’s official website (www.kinwong.com ) and public filings reveal no announced strategy to pivot toward AI, IoT, or 5G infrastructure. In an era where semiconductor supply chains are re‑shaped by geopolitical tensions and AI demand is surging, a PCB manufacturer that remains tethered to traditional manufacturing risks being left behind.

The company’s current management, led by a board that has historically focused on incremental improvements rather than transformative change, has not announced any plans to diversify product lines or pursue overseas expansion beyond “global operations.” This lack of ambition is particularly stark when compared to peer companies that are actively seeking to acquire semiconductor assets or launch new high‑margin product lines, as seen with Yingxin Development’s recent bid for Guangdong Changxing Semiconductor.

Investor Takeaway

Kinwong’s valuation, driven largely by speculative expectations rather than concrete fundamentals, is unsustainable in the long term. Investors should recognise the following risks:

- Commoditisation of Core Products – Without diversification, margins will erode.

- High P/E Relative to Peers – The company’s 54.89 ratio dwarfs the industry average, implying a steep correction is likely.

- Absence of Capital Inflow – The lack of financing and limited inclusion in “hot” investor lists signal weak demand.

- Strategic Stagnation – No clear roadmap to capture growth sectors such as AI, 5G, or advanced packaging.

Until Kinwong can demonstrate a tangible shift toward higher‑margin, high‑growth segments, the stock is a speculative play that is likely to underperform the broader market. The current trajectory suggests that a price correction will inevitably follow, benefiting only those who entered at a lower valuation.