Market Context and Strategic Outlook for Shenzhen Liantronics Co., Ltd.

The Chinese equity markets have been marked by a sharp contrast between sectors that have benefited from sector‑specific catalysts and those that have suffered from broader macro‑economic headwinds. While the aerospace and AI‑mobile sectors have seen the most activity—evidenced by a surge in trading on the “龙虎榜” and a flurry of涨停 (limit‑up) stocks—there remains a compelling narrative around companies that provide foundational infrastructure to these high‑growth areas.

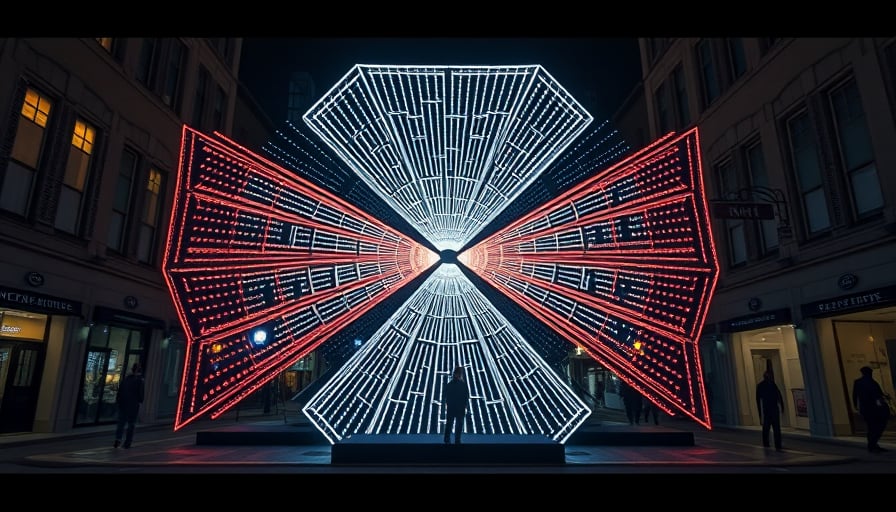

Shenzhen Liantronics Co., Ltd. (Liantronics) is one such company. Founded in 1998 and listed on the Shenzhen Stock Exchange, Liantronics specializes in the design, manufacture, and servicing of LED application products. Its portfolio spans indoor and outdoor rental LED displays, fixed LED panels, fine‑pitch panels, stadium, stage, advertising, mobile, and curtain LED displays, as well as front‑accessible LED signage and broadcasting‑studio solutions. The company’s products are exported to roughly 90 countries and regions—including Germany, Japan, the United States, Russia, India, and Brazil—underscoring its global reach.

1. Financial Snapshot (as of 2025‑12‑02)

| Item | Value |

|---|---|

| Close Price | 7.27 CNY |

| 52‑Week High | 7.97 CNY |

| 52‑Week Low | 2.8 CNY |

| Market Capitalisation | 3.99 billion CNY |

| P/E Ratio | 146.28 |

The high P/E ratio reflects market expectations of substantial growth, likely driven by the expansion of LED display demand in the advertising, entertainment, and smart‑city sectors. The current price sits comfortably below the 52‑week high, suggesting that a moderate upside remains on the horizon.

2. Product and Market Positioning

Liantronics’ core offerings align closely with the rising demand for dynamic visual content in several high‑growth sectors:

- Advertising and Retail – Outdoor and indoor LED panels are increasingly deployed in malls, high‑traffic streets, and corporate campuses to deliver real‑time marketing content.

- Entertainment and Sports – Stadium and stage LED displays provide immersive experiences for fans and performers, a segment that continues to grow with the proliferation of live events.

- Broadcasting and Video Conferencing – Front‑accessible LED signage and studio‑grade solutions cater to media production houses and corporate communication centers, both of which are embracing high‑resolution displays.

- Smart‑City Infrastructure – Municipalities worldwide are installing LED signage for traffic control, public safety alerts, and information dissemination, opening a long‑term growth channel.

The company’s export footprint across 90 markets mitigates concentration risk and positions Liantronics to capture demand shifts in developed economies, especially as the global transition to high‑definition visual media accelerates.

3. Competitive Landscape and Differentiators

In a market populated by numerous LED manufacturers, Liantronics differentiates itself through:

- Integrated Service Model – Beyond selling displays, the firm offers installation, maintenance, and technical support, generating recurring revenue streams and deepening customer relationships.

- Technology Leadership – The company’s fine‑pitch LED panels and high‑resolution solutions provide superior image quality, a key selling point for premium advertising and broadcast clients.

- Manufacturing Efficiency – Operating out of Shenzhen, a global electronics manufacturing hub, enables cost control and rapid scaling in response to demand spikes.

These attributes collectively strengthen Liantronics’ competitive moat, allowing it to sustain margin pressure even amid pricing headwinds.

4. Recent Market Dynamics

While the latest market activity—highlighted by the surge in “龙虎榜” activity for aerospace and AI‑mobile stocks—has not directly impacted Liantronics, the broader market environment offers indirect benefits:

- Capital Allocation – Investor enthusiasm for high‑growth tech sectors tends to spill over into adjacent hardware segments, potentially increasing capital inflows into companies like Liantronics that supply essential infrastructure to those sectors.

- Sector Rotation – As the market rotates from speculative tech to value‑oriented hardware, Liantronics, with its solid fundamentals and growth potential, stands to attract a new cohort of investors seeking exposure to the underlying supply chain.

- Policy Support – Chinese industrial policy continues to favour the development of advanced display technologies, including incentives for LED manufacturers that contribute to smart‑city initiatives and high‑tech entertainment infrastructure.

5. Forward‑Looking Assessment

Looking ahead, several factors suggest that Liantronics is poised for continued upward momentum:

| Driver | Impact |

|---|---|

| Growing Demand for Dynamic Content | Sustained need for high‑resolution LED displays in advertising, sports, and broadcasting. |

| Smart‑City Expansion | Municipal investments in LED signage for public information and safety. |

| Export Growth | Entry into new markets and deepening penetration in existing ones. |

| Operational Efficiency | Cost advantages from Shenzhen manufacturing base and integrated service model. |

Potential risks remain—particularly margin compression from commodity price volatility and intense competition from low‑cost rivals—but the company’s diversified product mix and service capabilities provide a buffer.

Conclusion Shenzhen Liantronics Co., Ltd. occupies a strategically advantageous position at the intersection of burgeoning visual‑content demand and global smart‑city infrastructure. Although recent market headlines have focused on aerospace and AI‑mobile stocks, the underlying demand drivers that benefit these sectors—dynamic displays and high‑resolution content—directly support Liantronics’ core business. With a strong export network, integrated service model, and technology leadership, the company is well‑placed to capture incremental upside as the LED display market expands across multiple high‑growth verticals.