Siasun Robot & Automation Co Ltd: Riding the AI Wave

In the ever-evolving landscape of the industrial sector, Siasun Robot & Automation Co Ltd stands out as a beacon of innovation and resilience. As of July 16, 2025, the company, listed on the Shenzhen Stock Exchange, has been making waves with its robust performance in the robotic industry. With a market cap of 266,311,960,014 CNY and a close price of 17.02 CNY on July 14, 2025, Siasun is not just surviving; it’s thriving.

The Surge in Robotics and AI

The recent market dynamics have been nothing short of a rollercoaster, with the A-share market experiencing a slight downturn. However, amidst this, the robotics sector, including Siasun, has seen a remarkable uptick. On July 16, 2025, the robotics concept stocks were particularly active, with companies like 上纬新材 (Xinwei New Material) and 浙江荣泰 (Zhejiang Rongtai) hitting their 10th consecutive day of gains. This surge is a testament to the growing importance and application of robotics and AI in various industries.

Why Siasun?

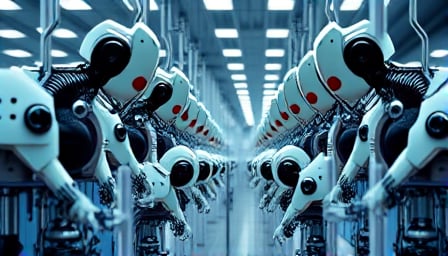

Siasun Robot & Automation Co Ltd, founded in 2000 and based in Shenyang, China, is at the forefront of providing collaborative, mobile, intelligent, industrial, and service robots. Their offerings span across chassis marriage and assembly AGV, spot welding, intelligent logistic systems, AS/RS systems, electronics assembly systems, automated vertical warehouse systems, and automated charging and swapping systems. This diverse portfolio not only showcases Siasun’s innovation but also its commitment to addressing the evolving needs of the industrial sector.

Market Sentiment and Future Outlook

The market sentiment towards robotics and AI has been overwhelmingly positive. This is further bolstered by statements from industry leaders and government officials emphasizing the rapid development and localization of the robotics industry in China. The recent commentary by Commerce Minister Wang Wentao highlighted the robust supply chain and complete industrial ecology supporting the robotics industry’s growth. Such endorsements are crucial for companies like Siasun, as they navigate the competitive landscape.

Moreover, the investment in robotics ETFs, such as the one managed by Yida (159530), which saw significant net purchases, indicates a strong investor confidence in the sector’s future. This financial backing is essential for research and development, enabling companies like Siasun to innovate and expand their offerings.

Conclusion

In conclusion, Siasun Robot & Automation Co Ltd is not just riding the wave of the AI and robotics boom; it’s helping to propel it forward. With a solid foundation, a diverse product range, and a positive market sentiment, Siasun is well-positioned to capitalize on the opportunities presented by the growing demand for robotics and AI solutions. As the industry continues to evolve, Siasun’s role as a leader in the field is not just expected but inevitable. The future looks bright for Siasun, and for the robotics industry at large.