Sichuan Changhong Electric Co Ltd: Riding the Wave of AI and Robotics

In the bustling financial markets of 2025, Sichuan Changhong Electric Co Ltd, a prominent player in the Consumer Discretionary sector, has been making headlines. Listed on the Shanghai Stock Exchange, the company, known for its diverse range of household electrical appliances, is witnessing a surge in interest, particularly in the context of the burgeoning AI and robotics sectors.

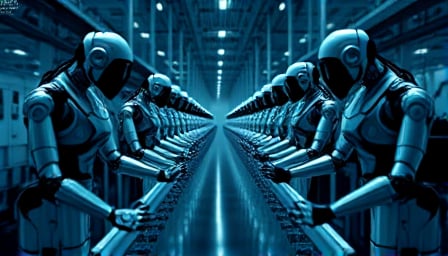

A Surge in AI and Robotics

The recent financial news highlights a significant trend: the rise of AI and robotics stocks. On August 19, 2025, the A-share market saw a remarkable increase in trading volume, with machine learning and robotics concepts leading the charge. Among the standout performers was Sichuan Changhong Electric Co Ltd, whose stock soared by 9.99% on the same day, marking its 77th entry into the top 10 most popular stocks over the past year.

Strategic Moves and Market Dynamics

The company’s strategic alignment with leading tech giants like Huawei has bolstered its market position. Longhui Jiahua, a subsidiary of Sichuan Changhong, has secured a total distribution authorization from Huawei Technologies Co Ltd for various products, including storage, network, security, and cloud services in mainland China. This partnership underscores the company’s commitment to integrating cutting-edge technology into its product offerings.

Moreover, Sichuan Changhong has announced a share buyback program, signaling confidence in its financial health and future prospects. The company plans to repurchase shares worth between 2.5 to 5 billion CNH, a move that is likely to enhance shareholder value.

Market Sentiment and Future Outlook

The broader market sentiment is optimistic, driven by policy support and international endorsements. The National Development and Reform Commission’s recent meeting emphasized the importance of boosting domestic consumption and investment, creating a favorable environment for companies like Sichuan Changhong.

International institutions, such as Swiss Re, maintain an overweight rating on Chinese stocks, citing improved profitability and shareholder returns as key factors. This positive outlook is further supported by the influx of funds into AI and robotics stocks, with Sichuan Changhong being a notable beneficiary.

Conclusion

As Sichuan Changhong Electric Co Ltd continues to leverage its strategic partnerships and capitalize on market trends, its stock remains a focal point for investors. With a robust market cap of 460.2 billion CNH and a price-to-earnings ratio of 53.456, the company is well-positioned to navigate the dynamic landscape of the Consumer Discretionary sector. As the AI and robotics sectors continue to evolve, Sichuan Changhong’s innovative approach and strategic initiatives are likely to drive its growth trajectory in the coming years.