Sichuan Chuantou Energy Co Ltd: A Strategic Focus Amidst Market Dynamics

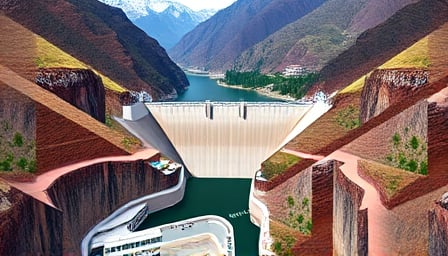

Sichuan Chuantou Energy Co Ltd, a prominent player in the utilities sector, has been making significant strides in the renewable energy landscape. Based in Chengdu, China, the company is actively engaged in electric power projects through its subsidiaries and is also involved in the development and manufacturing of cable, railroad control systems, and automation equipment. Listed on the Shanghai Stock Exchange since 1988, the company’s stock has been a focal point for investors, especially given its recent performance and strategic positioning.

Recent Market Performance

As of May 18, 2025, Sichuan Chuantou Energy’s stock closed at 17.19 CNH, reflecting a recovery from its 52-week low of 14.78 CNH on March 3, 2025. The stock’s 52-week high was 20.47 CNH, recorded on October 7, 2024. With a market capitalization of 84.18 billion CNH and a price-to-earnings ratio of 17.93, the company remains a significant entity in the independent power and renewable electricity producers industry.

Investor Interest and Institutional Support

Recent reports indicate a strong institutional interest in Sichuan Chuantou Energy. According to iFind, as of May 20, 2025, the company was among 106 stocks that had received net buying from institutional investors for five consecutive days or more. This trend underscores the confidence investors have in the company’s strategic direction and growth potential.

Strategic Developments and Legal Insights

On May 20, 2025, Beijing Da Cheng (Chengdu) Law Firm released a legal opinion regarding the 2024 annual shareholders’ meeting of Sichuan Chuantou Energy. This document, along with the company’s annual shareholders’ meeting resolutions, highlights the ongoing strategic initiatives and governance practices that are pivotal for the company’s future.

Sector Trends and ETF Performance

The broader sector trends also favor Sichuan Chuantou Energy. The Shanghai Stock Exchange’s 300 Red Dividend Low Volatility Index, which includes the company, saw a rise of 0.45% on May 20, 2025. The 300 Red Dividend Low Volatility ETF (515300) also experienced a 0.50% increase, reflecting positive sentiment towards dividend-paying stocks in the utilities sector.

Moreover, the China Domestic Low Carbon Economy Theme Index rose by 0.34% on the same day, with Sichuan Chuantou Energy’s stock up by 2.50%. The Carbon Neutrality ETF (159790), which tracks this index, saw a 0.36% increase, indicating a growing investor focus on sustainable and low-carbon investments.

Policy and Market Outlook

The recent policy directions from the China Securities Regulatory Commission, emphasizing cash dividends, share buybacks, and mergers and acquisitions, are likely to bolster the company’s investment value. Additionally, the gradual implementation of the 136th document’s supplementary provisions, aimed at enhancing urban renewal and green energy initiatives, presents a favorable environment for Sichuan Chuantou Energy.

Conclusion

Sichuan Chuantou Energy Co Ltd is well-positioned to capitalize on the current market dynamics and policy support. With strong institutional backing and a strategic focus on renewable energy and infrastructure projects, the company is poised for sustained growth. Investors and stakeholders should closely monitor the company’s developments, as it continues to navigate the evolving energy landscape with resilience and innovation.