China Petroleum & Chemical Corp: Financial Overview and Market Developments

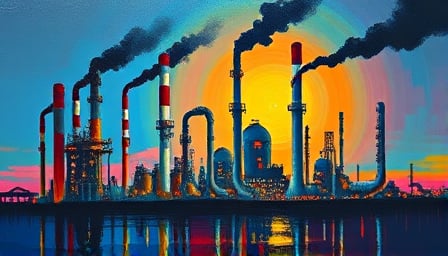

China Petroleum & Chemical Corporation, commonly known as Sinopec, is a major player in the energy sector, specializing in the production and trading of petroleum and petrochemical products. The company’s product range includes gasoline, diesel, jet fuel, kerosene, ethylene, synthetic fibers, synthetic rubber, synthetic resins, and chemical fertilizers. Sinopec markets its products throughout China and is listed on the Hong Kong Stock Exchange.

Financial Highlights:

- Close Price (2025-08-21): 4.41 HKD

- 52 Weeks High (2024-10-06): 5.47 HKD

- 52 Weeks Low (2025-04-08): 3.69 HKD

- Market Cap: 105,897,193,965 HKD

- Price Earnings Ratio: 13.79731

Recent Market Developments:

A-Share Market Dynamics:

- The A-share market has seen significant growth, with the Shanghai Composite Index surpassing 3800 points for the first time in ten years. As of August 22, 2025, the total market value of A-share companies reached approximately 116 trillion yuan, driven by strong performance from major state-owned enterprises and industry leaders.

Dividend Announcements:

- Many listed companies in China have increased their mid-year dividend payouts. As of August 24, 2025, 288 companies announced dividend plans totaling 16.65 billion yuan, with significant contributions from major players like China Mobile, China Telecom, and Sinopec.

Hong Kong Stock Exchange Adjustments:

- The Hang Seng Index will see changes in its composition, increasing from 85 to 88 constituents, including China Telecom, JD Logistics, and Pop Mart. These adjustments will take effect on September 8, 2025.

Investment in Recycling Technologies:

- Shanghai Lejia Technology, focusing on plastic recycling, has attracted significant investment from major energy and chemical companies, including Sinopec. This reflects a growing interest in resource recycling and the circular economy.

U.S. Energy Policy Shifts:

- The U.S. administration under President Trump has taken steps to reduce support for renewable energy projects, impacting the growth of wind and solar energy. This includes halting new approvals for wind and solar projects and reducing tax incentives for renewable energy investments.

Company-Specific Developments:

- Wanrun Group:

- Wanrun Group has seen increased demand for its downstream products, particularly in the liquid crystal materials sector. The company’s strategic focus on semiconductor manufacturing materials and high-performance polymers has strengthened its market position.

Sinopec continues to play a crucial role in China’s energy landscape, with strategic investments in innovation and sustainability shaping its future growth trajectory.