Spod Lithium Corp: A Glimmer of Hope or a Mirage in the Lithium Market?

In the ever-evolving landscape of the global lithium market, Spod Lithium Corp emerges as a company with ambitious goals and a singular focus on the lithium sector. As a Canadian mineral exploration company, Spod Lithium Corp is laser-focused on the acquisition, exploration, and development of lithium properties. But with a market cap of just 1.66 million CAD and a share price that has plummeted to a mere 0.02 CAD as of August 26, 2025, one must ask: is Spod Lithium Corp a beacon of potential or merely a speculative gamble?

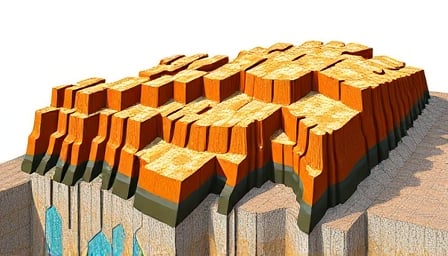

The Spearmint Lithium Project: A Promising Venture?

At the heart of Spod Lithium Corp’s operations lies the Spearmint Lithium Project, situated in the Lithium Triangle of the Western Athabasca Basin in Canada. The company holds a 100% interest in this project, positioning itself as a key player in one of the most promising lithium-rich regions globally. However, the question remains: can Spod Lithium Corp capitalize on this asset to deliver tangible results?

Financial Turbulence: A Red Flag for Investors?

The financial indicators for Spod Lithium Corp paint a concerning picture. With a 52-week low of 0.01 CAD and a high of 0.055 CAD, the volatility in its stock price is evident. Moreover, the company’s price-to-earnings ratio stands at a troubling -1.14, signaling potential financial instability. For investors, these figures are a stark reminder of the risks associated with investing in a company that has yet to prove its profitability.

Environmental Commitment: A Genuine Effort or a PR Stunt?

Spod Lithium Corp prides itself on its commitment to responsible mining practices and environmental sustainability. In an industry often criticized for its environmental impact, this commitment could be a significant differentiator. However, without concrete evidence of sustainable practices and tangible results, these claims risk being dismissed as mere public relations efforts.

The Road Ahead: Potential or Pitfall?

As Spod Lithium Corp navigates the complex terrain of the lithium market, its future hinges on several critical factors. The company must demonstrate its ability to effectively develop its lithium assets and deliver on its promises of environmental responsibility. Failure to do so could result in further financial decline and loss of investor confidence.

In conclusion, while Spod Lithium Corp holds potential due to its strategic positioning in the Lithium Triangle, the company faces significant challenges. Investors and stakeholders must remain vigilant, scrutinizing the company’s actions and financial health closely. Only time will tell if Spod Lithium Corp can transform its promising assets into a sustainable and profitable venture.