Sterling Metals Corp: A Glimmer of Hope Amidst Financial Turbulence

In a world where the metals and mining sector often faces the brunt of economic fluctuations, Sterling Metals Corp. has emerged as a beacon of potential, despite its recent financial struggles. With a market capitalization of 8.04 million CAD and a troubling price-to-earnings ratio of -5.76, the company has been navigating through turbulent waters. However, the latest developments at its Soo Copper Project could be the lifeline it desperately needs.

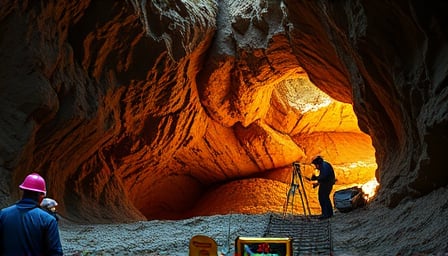

A Promising Discovery at Soo Copper

On May 29, 2025, Sterling Metals Corp. announced a significant breakthrough at its Soo Copper Project, formerly known as Copper Road, located in Batchewana Bay, Ontario. The company reported intersecting 359.3 meters of 0.36% Copper Equivalent (CuEq) from near the surface, with multiple zones of bornite across a preserved porphyry copper deposit. This discovery was made in the first of four diamond drill holes (MJ-25-01), marking a pivotal moment for Sterling Metals.

The drill results have unveiled a continuous, bulk-tonnage copper-molybdenum-silver-gold (Cu-Mo-Ag-Au) target, known as the GFP Porphyry. This target is characterized by a broad, near-surface zone of high tenor chalcopyrite-bornite copper mineralization, starting at 14.3 meters and grading 0.36% CuEq over 359 meters. Notably, the first 75 meters of this interval boast an impressive 0.56% CuEq.

Implications for Sterling Metals Corp

This discovery is not just a testament to the geological potential of the Soo Copper Project but also a potential game-changer for Sterling Metals Corp. The presence of multiple zones of bornite and the association with a multi-porphyry intrusive complex suggest a significant mineral potential that could attract investor interest and potentially stabilize the company’s financial standing.

Despite the company’s recent low close price of 0.27 CAD on May 26, 2025, and a 52-week low of 0.24 CAD, the promising results from the Soo Copper Project could serve as a catalyst for a turnaround. The exploration success highlights the company’s strategic focus on copper, gold, zinc, and lead exploration in central and South America, reinforcing its position in the materials sector.

A Critical Look Ahead

While the discovery at the Soo Copper Project is undoubtedly a positive development for Sterling Metals Corp., it is crucial to approach the future with a critical eye. The company’s financial health, marked by a negative price-to-earnings ratio, underscores the challenges it faces in capitalizing on its exploration successes.

Investors and stakeholders will be keenly watching how Sterling Metals leverages this discovery to improve its financial metrics and market position. The coming months will be critical in determining whether the Soo Copper Project can indeed be the silver lining Sterling Metals needs to navigate through its financial storm.

In conclusion, while Sterling Metals Corp. stands at a crossroads, the recent discovery at the Soo Copper Project offers a glimmer of hope. It is a reminder of the potential that lies beneath the surface, waiting to be unlocked. However, the path forward requires strategic execution, financial prudence, and a bit of luck. Only time will tell if Sterling Metals can turn its promising geological discoveries into financial success.