Sunshine Global Circuits Co Ltd: Market Dynamics and Industry Trends

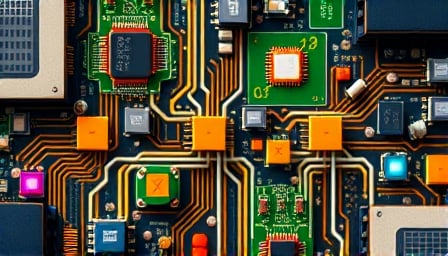

Sunshine Global Circuits Co Ltd, a prominent player in the Information Technology sector, specializes in manufacturing and selling a variety of printed circuit boards. These products are integral to numerous applications, including industrial control, telecommunications, medical electronics, automotive, power supply, and green energy. Listed on the Shenzhen Stock Exchange, the company has shown resilience in a fluctuating market environment.

Recent Market Performance

As of July 13, 2025, Sunshine Global Circuits Co Ltd’s close price stood at 15.06 CNY, with a market capitalization of 4,915,241,431 CNY. The company’s 52-week high was recorded at 20.28 CNY on December 17, 2024, while the low was 9.83 CNY on April 8, 2025. The price-to-earnings ratio is notably high at 323.546, reflecting investor expectations of future growth.

Industry Trends and Influences

The recent surge in CPO (Co-Packaged Optical) stocks, including industry leaders like New Easy Shine, has been attributed to Nvidia CEO Jensen Huang’s visit to China. This visit, coupled with Nvidia’s announcement to resume sales of its H20 in China and introduce new GPUs compatible with the Chinese market, has sparked significant interest. Nvidia’s reliance on high-speed optical modules and CPO technology has positioned companies like New Easy Shine as key suppliers, leading to a substantial increase in their stock prices.

Market Activity and Investor Sentiment

On July 15, 2025, the ChiNext board saw a notable increase in trading activity, with the index rising by 1.73% to 2235.05 points. The total trading volume reached 44,774.44 billion CNY, marking a significant increase from the previous trading day. Among the stocks, New Easy Shine experienced a remarkable 20% rise, reaching a new high. This surge is part of a broader trend where CPO-related stocks have seen substantial gains, driven by the anticipated demand for AI infrastructure components.

High Turnover Stocks

The ChiNext board’s high turnover stocks included several companies with significant trading volumes and price movements. Notably, New Easy Shine, with a 20% increase, and other CPO-related stocks like Dongtian Micro and C Tongyu, experienced substantial gains. The high turnover rate indicates strong investor interest and market volatility, with some stocks like Xingling Electric and Yanda Communication also seeing significant trading activity.

Conclusion

Sunshine Global Circuits Co Ltd operates in a dynamic industry influenced by technological advancements and market demand for electronic components. The recent developments in the CPO sector, driven by Nvidia’s strategic moves, highlight the interconnected nature of global tech industries and their impact on individual companies. As the market continues to evolve, Sunshine Global Circuits Co Ltd’s performance will likely be closely tied to these broader industry trends.