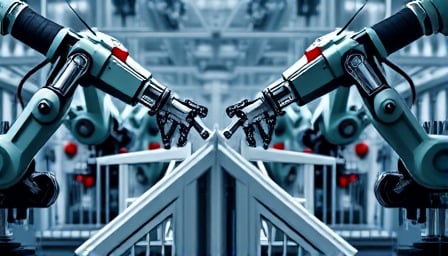

Sunward Intelligent Equipment Co Ltd: A Glimpse into the Future of Industrial Automation

In the bustling industrial sector, Sunward Intelligent Equipment Co Ltd stands out as a beacon of innovation and technological advancement. Based in Changsha and listed on the Shenzhen Stock Exchange, Sunward has carved a niche for itself in the machinery industry, specializing in the development, manufacturing, and marketing of industrial automation equipment. With a market capitalization of 126.2 billion CNH and a close price of 11.01 CNH as of July 24, 2025, the company’s financial health is robust, albeit with a high price-to-earnings ratio of 148.68, reflecting investor confidence in its future growth.

Sunward’s product portfolio is diverse, ranging from hydraulic excavators, including mini-type and intelligent hydraulic excavators, to hydraulic static pile drivers and hydraulic downhole drilling rigs. This variety not only showcases the company’s versatility but also its commitment to meeting the evolving needs of the industrial sector.

A Leap into the Future: The Launch of “Lingkuo”

In a significant development, Sunward’s subsidiary, NetEase Lingdong, unveiled a groundbreaking concrete model for open-pit mine excavators at the World Artificial Intelligence Conference (WAIC) on July 26, 2025. This model, named “Lingkuo,” represents the first of its kind globally, designed specifically for the loading scene in open-pit mines. This launch aligns with the strategic goals set by the National Energy Administration for the intelligent and unmanned operation of large open-pit coal mines by 2025, providing a scalable technological blueprint for the “Intelligent Coal Mine Construction Guide.”

“Lingkuo” is a pioneering “end-to-end” concrete model for engineering machinery, leveraging multimodal data-driven autonomous learning technology. This innovation marks a departure from traditional development models, offering a unified model that significantly enhances generalization performance. The training data, sourced directly from real mine operation scenarios, addresses challenges that simulated data cannot, ensuring the model’s effectiveness and reliability. Furthermore, the model is built on a self-developed domestic framework, emphasizing the importance of national self-reliance in core algorithms and technologies.

Market Movements and Investor Interest

The financial landscape surrounding Sunward and its peers in the industrial sector has been dynamic. On July 25, 2025, the stock market witnessed significant movements, with the Shenzhen Stock Exchange showing a positive trend. Notably, companies like Shanhe Zhihui (002097) and Xining Special Steel (002097) experienced a “5 consecutive board” phenomenon, indicating strong investor interest and confidence in their growth prospects.

Shanhe Zhihui, in particular, has been in the spotlight, with its stock price experiencing fluctuations. Despite a 6.22% drop on July 25, the company’s popularity surged, climbing to the 8th position on the Tonghuashun Hot List. This interest is further evidenced by the substantial main force capital inflow of 5.38 billion yuan on the same day, highlighting the market’s bullish sentiment towards Shanhe Zhihui.

Conclusion

Sunward Intelligent Equipment Co Ltd, through its innovative products and strategic initiatives like the launch of “Lingkuo,” is at the forefront of the industrial automation revolution. The company’s strong financial performance, coupled with the market’s positive reception to its technological advancements, positions Sunward as a key player in shaping the future of the machinery industry. As the company continues to expand its product offerings and embrace cutting-edge technologies, it remains a compelling choice for investors looking to capitalize on the growth of the industrial sector.